“It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.”

— Robert Kiyosaki ( American businessman and author))

I believe and so renowned entrepreneurs would also agree that Professional finance guidance is a key to success for every SBO (small business owner) in today’s booming startup era.

According to the study of Schwab’s 2024 Modern Wealth Survey, Only 36% of Americans have a written financial plan, the rest 43 % are still struggling in terms of financial credibility

. What this data showed is that people struggle to manage their finances in the early stages of their growing business due to which they suffer losses which also slow down their growth in the race of leading business industries.

So how can a business owner find a way to unlock the exponential growth of their business? Don’t worry, By the end of this article, you will be doubtless about your financial problems through these 6 solutions I’m going to provide

Expert CFO Services

Expert CFO services or in other words virtual CFO services are the financial management advisors that provide solutions to the money-making problems of the founders and CEOs

- If you envision accelerating your company’s profit and becoming better than your competitors, this service is a must-have.

- With the advisory of these experts, you can accommodate and excel in your progress. You will also get to know the unknown insights and budget management for your company, which will make your company’s health better in the long run.

- This team is also responsible for managing your cash flow and money-investing risks that bring assistance to your business in uncountable ways.

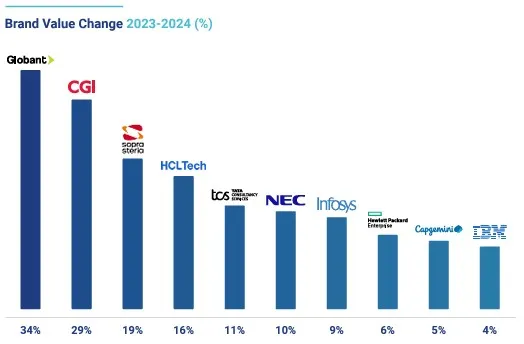

As you can see this graph shows the practical growth of IT companies after appointing CFO services.

Taking advantage of fractional CFO resources can guarantee better financial oversight without the cost of a full-time executive. This allows growing companies to access expert guidance while still keeping their budgets under control.

If you are also looking for CFO services, you can check out

CFO services in Dubai, CFO services in India, CFO services in the USA on Google. to find an alliance of people who are keen to enhance your finances in your terrain

Enhanced Financial Strategy

I believe a good financial strategy can open doors for those building their dream projects and brands into reality. A growth-making strategy requires asset management and complete fund tracking in a diverse yet simplified way.

But how can we create a good financial strategy?

- To create a good financial strategy, you must know your aspirations and the current situation of your company to determine and create a roadmap leading to your success.

- The historical data, goals, opportunities, and risks should be cleared in detail by the owner in the first place.

- After clarifying all these data we can start focusing on achieving the desired targets by focusing on our in-hand resources and skill set, we have

Good planning will define the future possibilities of a company in its related sectors due to which more investors get interested and milestones will be crossed.

Improved Cash Flow Management

I personally think ‘A company with good cash flow can never fail’ because if you master the art of making money from money, there is no going back. Wealth management is a process that helps to create good health when it comes to accounting your banking books!

Let me tell you some tips to make it better and bring in cash flow in some easy steps.

- By prioritizing the distribution of invoices to your customers can help you keep a precise record of your selling products and profit generation.

- To make your business available to a larger domain you have to give more payment options to the consumers like cheques, crypto, UPI, etc. so that their experience becomes hassle-free

- Managing stock inventory and reevaluating the pricing of the products or services can be beneficial because in today’s era trends and demands change in a blink of an eye.

Did you know?

One of the primary benefits of effective cash management for small businesses is improved financial stability. . (source: Guilford savings bank )

Strategic Investment Decisions

Strategic investment can help a company grow faster than their expectations. These roadmaps of moneymaking can be classified as a smart move against competitors and increase the market share to stand on the topmost ranks of your desired sectors.

- These investing decisions are very crucial for companies because they help to provide evaluation, growth tactics, partnerships, and even IPOs

- If you consider Purchasing shares in startups that are working on the technology or something useful to human resources of the future can also be a good decision in the long tendency of the time.

- Not only these types of assets can be useful for strategic investment but they can also be commodities like real estate, precious metals, and ancient artifacts, which also play a very significant role in business money management.

Risk Management and Compliance

One of the major terminal factors in growing your financial investment is Risk management and compliance. This point is very crucial for brands because it defines a future of a company that it will sustain in the future or not. It also requires a deep study of policies and regulations to avoid violations of public domains.

- This stage involves management involves monitoring compliance risks through the vision of your organization, it also helps to minimize the future risks of investment threats.

- The Board of directors of an organization is responsible for creating the types of risk management policies by keeping the regulations, laws, and government advisories in mind.

- By creating these terms, the company can play a safer side when it comes to taxation charts or institutional and law books of government.

Building a Financially Savvy Team

If you have capital, a risk management team, and a good amount of cash flow, what more do you need to create an established brand well let me remind you a financially savvy team is a must to onboard in your organization

But why so?

- I think to build a phenomenal business you need to build a team that has core knowledge of maintaining finances at their fingertips.

- A financially savvy team requires people who are keen to understand the marketing and investment trends to make the company’s future sustainable.

- This team will ensure owners by managing their debts and generating profits from their products and services so that the aims of companies growth are fulfilled.

Conclusion

To sum up this blog post, I just want to say that hiring an expert CFO service ensures the financial stability of your organization. A well-planned strategy helps you manage your cash flow and risk management.

With these conventional methods, you can overcome money-related hurdles in future capital expenditures and trade-offs.