No business can survive without money. Finances play a more important role than just providing capital for operations.

The financial situation of a company can teach you a lot. It can give you an idea of how it is performing and its growth over time. Anyone running a business knows just how important accounting and proper financial management by an expert like Howlader & Co. are for a company.

In this blog post, we will take a look at what accounting is and its role in a business environment. Also, learn about AI Tools For Small Business Accounting by reading this article.

What is Accounting?

Accounting in a sense is a broad term we use for everything finance-related in a business setting. It is the process of keeping track of all the financial transactions (like inflow, outflow, expenses, etc.) of a company.

Accounting is not only used for record-keeping, it also helps with general business management. Accounting can help businesses analyze their financial transactions and make important decisions about their future.

The Right Accountant

There are plenty of different types of accounts for businesses to utilize. It’s important to note whether the account you chose has the correct qualifications to ensure a seamless partnership.

For example, a Certified Management Accountant (CMA) may have studied a Lamar online degree, a chartered accountant like THP at New York University, or a public account at Harvard University.

Why is Accounting Important for Businesses?

Accounting services are the core of any good business. Without proper financial management, no company can keep running.

With financial accounting, a business can easily keep track of income and expenditures, ensure compliance, and provide its investors, management, and government with a quantitative list of financial information.

DID YOU KNOW?

According to the Accounting Today 2022 Year Ahead Survey, 51% of firms said their biggest challenge is keeping up with regulatory change.

There are usually three types of statements that businesses generate from their finances:

- Income Statement: This gives you an idea of if the business is making a profit or a loss.

- Balance Sheet: Gives you a clear picture of where your business stands on any particular date.

- Cash Flow Statement: This is basically the record of all the money coming in or being spent in a company while running its daily operations.

Businesses need to make sure that they keep these records clean and updated to help them stay afloat.

What is the Role of Accounting in Business?

Accounting can give businesses a ton of data that they can use to make decisions about their future. Here are a few examples:

It Can Help You See How Your Business is Performing

The financial records of a business show how your business is doing overall, especially in terms of finances.

Clean and updated financial data can help you track expenses, giving you present and past data to compare to determine whether your company is profitable.

For example, if you compare your company’s expenditures from the previous year with the current one, you can easily see whether the profit margins have improved or not.

These insights give businesses the opportunity to adjust their strategies and processes to keep in line with their financial situation.

It Helps Maintain Compliance With Tax Laws and Regulations

Every country has its own laws and regulations for business. Having proper accounting records and processes can help companies ensure that they are following all the local tax and statutory laws.

You can ensure that your company not only fulfills its tax obligations but also addresses its employees’ pension funds.

You Can Manage Budget and Make Future Projections

Financial records can help you make decisions for creating operating budgets as well as account for future trends well in advance.

Accounting can help you analyze all the past financial data and see which of your operations are profitable.

This will also give you an overview of which services or departments are performing poorly and make predictions on what future market trends will be like.

It Helps in Filing Your Financial Statements Correctly

One of the most important things that accounting does for businesses is helping them maintain their financial statements. This data can be used for other purposes.

For example, come tax season, you will have an itemized list of all the transactions made by your business. This way, you can not only file your taxes without any fines, but you may even save some money on rebates.

Aside from all this, accounting statements can also be very useful when auditing, planning a merger, or considering acquiring another business.

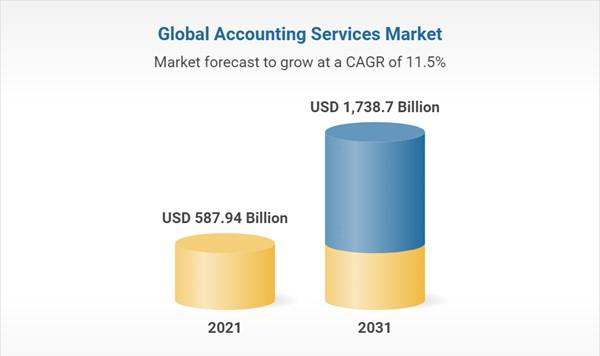

The accounting services global market value was $544.06 billion in 2020. The market is expected to reach $735.94 billion in 2025.

Conclusion

Accounting is a major part of any business; it takes care of recording, keeping track of, and analyzing all the financial transactions within a company.

This can help businesses track their financial health and make decisions to increase profits and prepare for future trends.

It also helps companies maintain compliance and handle their taxes in a more responsible way as well.