Two same amounts can be completely different when associated with different state taxes and international payment systems.

When professionals consider their salary offer – most of them stop at the headline number. It looks attractive on paper, feels promising and often becomes one of the major decisions of life. But just like any other financial statement – numbers don’t share the complete story.

What gets shared is a luring number – which shows what flows in before deductions. For any professional who works with just numbers, skipping the calculator is the same as approving a balance sheet without confirming the expenses.

Read this post to understand how to move from gross revenue to your net bottom line and analyze its caution.

Performing the Due Diligence on Your Largest Asset

Before you can budget, invest, or plan, you need an accurate forecast of your primary cash inflow. Relying on a rule-of-thumb percentage for “taxes” is akin to estimating major business expenses it introduces unacceptable risk into your financial model.

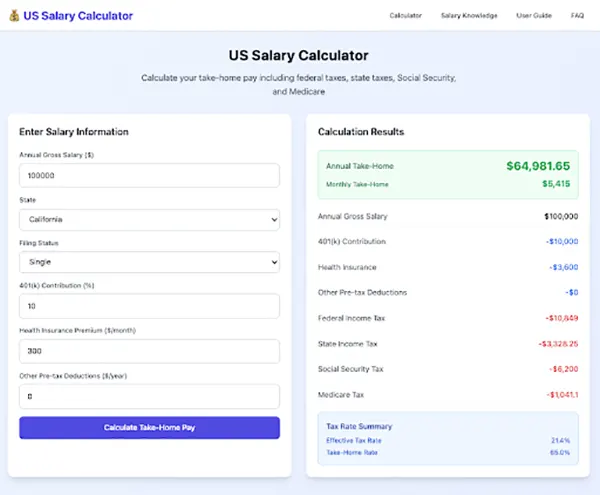

Your work location is the single greatest variable in this equation. A $120,000 salary has a completely different net result in Seattle, Washington, than it does in Miami, Florida, due to state income tax. The variance grows exponentially when comparing the U.S. system to the social security contributions and progressive tax bands in the UK, Germany, or Japan. This isn’t a minor adjustment; it’s a fundamental recalculation of the offer’s value.

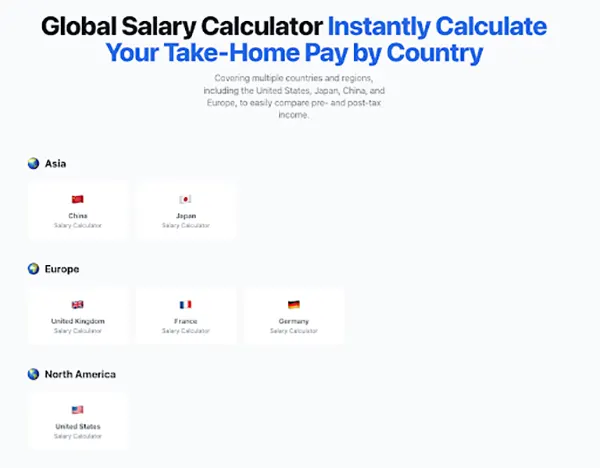

This is where a precise global salary calculator functions as your essential reconciliation tool. It doesn’t estimate; it calculates. By applying the specific, current tax codes and deduction schedules of the destination, it transforms a gross salary into a reliable net income forecast. For an accountant or consultant evaluating a U.S. role, using a dedicated net salary calculator USA is a necessary step to accurately model federal tax, FICA, and the critical state-level variable, providing a clear picture of disposable income.

Building a Personal Financial Model on Accurate Data

With a verified net income figure, you can move from speculation to strategic financial planning. This clarity will ensure your personal decisions align with your future goals.

- Negotiate with the precision of a forensic accountant. Entering compensation discussions with a calculated net-income projection shifts the dialogue. For a specific financial outcome based on the cost structure of the location – you might plan to support it once. This will move you forward to more complex discussions that may include tuning the mix of salary, benefits, and allowances for tax efficiency.

- With a relaxed mind, do a detailed analysis of opportunities. Ask yourself– Is a higher gross salary in a high-tax state truly more valuable than a slightly lower one in a no-tax state? Does an overseas package with complex allowances actually net out favorably? A platform with localized calculators for key economies allows you to run scenario analyses, comparing the true net value of each offer on a consistent basis.

- Mitigate tax liability and cash flow risk. An international relocation can create complex tax residency issues and unexpected liabilities. A robust salary calculator helps identify these exposures in advance, allowing for proactive planning with a tax professional. It makes sure that your personal cash flow prediction for the transition year is realistic and accounts for all withholding.

The Professional Standard for Personal Finance

In our field, we trust verified calculations, not estimates. The common anxiety about “moving into a higher tax bracket” reducing net pay is a miscalculation it misunderstands the progressive nature of tax systems. A professional-grade tool provides the audit trail, demonstrating through line-item deductions that higher gross income always results in higher net income.

For the professional who values accuracy, this process is a logical extension of your expertise. It’s applying the principles of diligent accounting verification, reconciliation, and clear reporting to your most important financial input.

Before you finalize your next career move, apply your professional standards. Don’t just review the gross revenue of your salary; complete the reconciliation to find your true net bottom line. It’s the most critical calculation you’ll make for your personal ledger.

Conclusion

Gross salary is the starting point – not a conclusion. Accurate financial details are shared when you figure out what you will be earning, saving, spending and planning with. Once you become aware of your true home pay, relocation decisions and future planning, then you become grounded with reality instead of just predictions.

Before accepting your next offer or deciding to move, analyze your salary the same way you would your personal account. The net bottom line is driven by real financial data – not the numbers printed on the top of your offer letter.