Digital technology is the same revolution as adding sound to pictures, and the same revolution as adding color to pictures. Nothing more and nothing less.

- George Lucas (Filmmaker and Philanthropist)

Isn’t it so convenient that I can now make huge transactions in seconds, sitting in the comfort of my house, without worrying about theft or robbery? Welcome to the world of digital payments!

It is reported that more than nine out of ten consumers have used a digital payment method in the past year. (McKinsey & Company: Consumer Digital Payments)

Gone are the days when I had to carry a wallet to keep my cash and worry about keeping it safe every 5 minutes because online payments have simplified everything.

Let’s take a deeper dive into this topic to understand the hype around digital payments and learn why it is considered the most secure, swift, cost-effective, and convenient payment method.

The Rise of Digital Payment Systems

The concept of digital payments has been around for a long time, but what really acted as a catalyst to popularize this trend was the contactless payment methods during the COVID-19 pandemic.

What started as a precautionary method has now turned into a lifestyle habit, and why wouldn’t it be? After all, these solutions are much more secure convenient, and align perfectly with our modern lifestyle.

Not only local transactions, but these methods are the perfect choice for international money transfers as well. Now I send money to Philippines from USA, without having to wait in queues, and also eliminating the high bank fees associated with traditional methods of international payments.

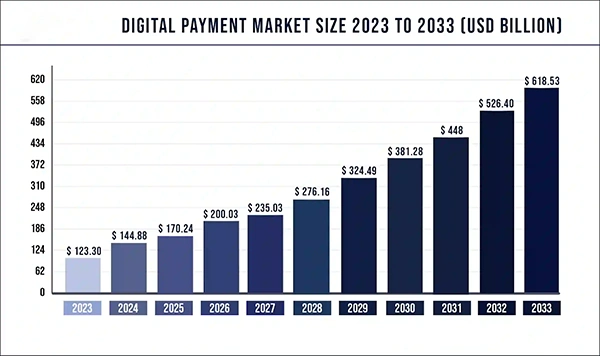

Due to the numerous benefits offered, the digital payment market is on the rise, as can be observed from the graph below.

Security Features of Digital Payments

I have been saying that digital payment methods are safer than traditional ones. But what exactly are the features that make it this safe and secure?

To minimize the risk of unauthorized access and prevent fraud, online payment systems use various security measures, including encryption, tokenization, multifactor authentication, and system authentication protocols. Millions of people trust these protective measures to keep all sensitive and financial information safe throughout the process.

Though these practices are not 100% foolproof and many consumers have reported losing millions in online frauds, that is why major payment providers invest significantly in their services, updating them from time to time.

Businesses in the financial sector who do make use of sanctions screening software, minimize their reputational damage and help combat money laundering and other financial crimes. Explore SEON’s comparison and reviews to find the best solution for your business.

Cost-Effectiveness of Digital Payments

Digital payment methods have eliminated the need for intermediaries for money transfers, significantly cutting costs. I remember standing in long queues in the bank for money transfers, just to be greeted with additional costs and fees for my being added to the amounts for transactions.

But now, many peer-to-peer payment systems charge minimum or no transaction fees, proving to be an excellent solution for those who are regularly involved in international money exchanges

Types of Digital Payment Solutions

Not only are digital payment methods convenient, but they also provide you with a broad range of platforms to choose the one that suits you the best. Some of the most commonly used options include:

- Mobile wallet: Mobile wallets are a popular choice these days due to their convenience. You can make transactions through these wallets in just a few taps, making them the perfect solution for everyday exchanges. Some widely used services are PayPal, Apple Pay, and Venmo.

- Peer-to-peer services: P2P systems are often online portals or mobile apps that allow users to transfer money directly from one account to another.

- Ecommerce Platforms: These days, ecommerce platforms have started providing integrating payment solutions to their customers, offering them better and seamless shopping experiences. Not only that but now, subscription models have also emerged that enable recurring payments for services such as streaming or software solutions.

FUN FACT

Half of all e-commerce transactions come from mobile wallets.

Challenges Facing Digital Payment Adoption

As the saying goes, “Every coin has two sides.” The same goes for this as well. We can weigh all the benefits and advantages offered by these systems on one side and some challenges that are being faced for digital payment adoption on the other. But what are these challenges?

To be honest, shifting to digital methods of payment is a long road to cross, and we have covered a long way but still, there are some challenges associated with them, some of them are as follows :

- Lack of knowledge and resources: We are living in the 21st century, but still not everyone has the access to internet and financial literacy to carry out online payments.

- Customer trust: Many people are still skeptical about this shift or approach from traditional to online money exchanges.

- Privacy Concerns: Many customers remain wary of online payments due to privacy concerns and the risk of sensitive information leaks.

- Secure and reliable processing: As this method of payment becomes more popular, an increase in cybercrime and fraud attempts has also been observed.

Future Trends in Digital Payments

Looking ahead, I can say that due to the convenience and various additional perks offered, digital payment methods will only gain more popularity among common people. With the advancement of technology and the implementation of modern innovations like artificial intelligence (AI) and machine learning, online payment methods will only get more secure, safe, cost-effective, and convenient.

In conclusion, digital payments have significantly transformed the way we exchange money. The various layers of precautionary measures like encryption, and MFA make it a much more secure way of transaction. Not only that, but online payments have also made it a matter of seconds to send money to any corner of the world, without having to wait in long lines in a bank or paying transactional fees.

Yes, there are a few challenges people are facing in adopting these methods, but as technology advances and new innovations debut, we can expect online payment methods to become more prevalent in the future.