Who doesn’t want to make their payments safe and secure? Every year, more than a million transactions are done in Mexico. Either it is for helping your family or close ones, or related to the business deals. This exchange of money and funds has become a necessity, but ensuring safe transactions has never been more important.

In a world where online scams are becoming a normal headline in the newspaper, remittance services have stepped in to strengthen the security game. From keeping your funds safe through advanced monitoring to instant alerts for every transaction, these services ensure safety for every transaction made.

Want to secure your next transaction? Continue reading to discover how remittance services keep money transfers to Mexico safe and secure. Learn how you can stay protected while sending money.

Key Takeaways

- For protected payments, always use remittance platforms to transfer money to Mexico.

- 24/7 monitoring of your transactions adds an additional protection.

- With instant alerts, every transaction is transparent to you.

- Staying alert is always an add-on to safe and secure money transactions.

Secure Transactions Protect Your Money

Protected and safe transactions should be the priority at every moment. And remittance services have a feature of end-to-end transactions, which ensures that all of your personal information will be converted into a safe and secure transaction.

Even your banking networks and payment gateways are verified and safe. Compliance with international standards like PCI DSS (Payment Card Industry Data Security Standard) is also followed. Check out the guide about how to send money to Mexico (como enviar dinero a Mexico).

On top of this, they provide you with licensed and authorized providers. And the most important thing is that they are monitored by financial authorities, which assures you that they are following strict security and anti-money laundering (AML) rules.

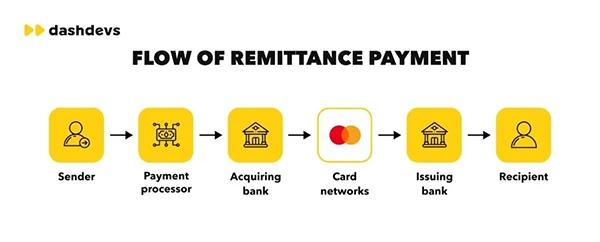

The following image shows the simplified flow of payment by remittance services – from sender to recipient.

Identity Verification Matters

Security doesn’t begin at the moment you send money, but it starts with the moment you start creating your account. Remittance platforms ask you to fill in your details, and it is not any other formality, such as Know Your Customer(KYC). But it is a key defence mechanism.

By verifying your details, these platforms make sure that no one else would be able to access any of your personal assets without your permission. This, in turn, helps to avoid any fraudulent activity, such as sudden money deduction from an account.

Although this might seem like an extra step but it also acts as a way to build trust between the customer and service provider. And keeps your money in safe hands.

Fraud Monitoring Keeps Funds Safe

You may not see it, but the advanced technologies are always at work to constantly monitor your transactions and check their authenticity. Many of the modern remittance platforms take help from AI-driven fraud detection services.

These detection services keep their eye on every transaction, such as, transfer of a large amount of money, or login attempts from any other device. If anything is out to be unusual, then the payment is verified through various steps before moving forward. This works as a proactive security guard and ensures safe funds.

Instant Alerts for Every Transaction

Every transaction needs to be crystal clear; that is why you receive an email or SMS after the payment. These instant alerts make sure you are aware of any activity with your account, whether it is related to just verification or the transfer of money.

From the moment the money is deducted from one account to the time it is received, the server sends messages as a report at every step. It is simply an effective step towards transparency and security, which allows you to take instant action against any fraud or suspicious activity.

How Can Users Stay Protected When Sending Money?

Even after all the barriers in the way of fraud, a user plays an important role in keeping their money safe. Here is how:

- Before making a payment, always make sure the platform is verified and authenticated. And avoid clicking on suspicious or fraudulent links or messages.

- Always make sure you create strong passwords. Accounts with weak and predictable passwords are often targeted by criminals.

- Enable two-factor authentication (2FA) security before making a payment.

- For complete security, double-check the receiver’s details.

Conclusion

In this digital world, modern remittance services have made it very safe and secure to send money to Mexico, from monitoring every activity to safeguarding your funds through built-in features. These secured payment platforms, active user habits, ensure a safe experience when integrated with active user habits, ensuring protected and secure payments to Mexico.