Have you ever wondered what tax credits are? And how you can benefit from them? If you own a business big or small but do not opt for it, then you are failing to save a lot of money.

According to a case study, “It was started in 2003 and since then tax credits have made a substantial difference in employment rates, income, and poverty levels for families, especially for lone-parent families.” (ResearchGate: Tax credits: A close-up view)

In this article, I’ll tell you what you need to learn about claiming tax credits as a small business owner. It is going to help you in several ways, so pay attention.

Understanding Tax Credits

You know how sometimes you have redeemable points, and you can use them to get some discounts on any goods? It’s just like that Tax Credit reduces the amount of tax that you have to pay to the government.

For example, if your tax is $2000, and you have a tax credit of $500 you’ll only pay $1500. You can think of it as a rebate. You usually achieve it when you are charged more tax than you should.

The excessive tax is converted into financial assistance, which you can use in the future. It reduces burdens on small businesses at the time of paying their taxes.

Types of Tax Credits for Small Business Owners

There are several types of tax credits for small commercial owners, each with different eligibility requirements. Learn about them below:

General Business Tax Credit

All your previous activities will be taken into consideration, from investments in green energy to research. Based on it, commendation may apply, and you can calculate it by using www.g6consulting.ca/sred-calculator/. This would show you the amount of tax credit you can qualify for.

Work Opportunity Tax Credit

A company that hires individuals with disadvantages like long-term unemployment, ex-felon, or veterans, then the government will give this assistance. This ensures that everyone is given equal opportunities in the work environment.

Small Employer Health Insurance Credit

If you are given health insurance even after being a small business, then you might be eligible for this tax incentive. But, you have to have less than 25 employees, and you must be covering 50% of their insurance. Since it takes money out of the profit, receiving credit helps you.

Disabled Access Credit

Several small businesses require your physical presence, and they do hire people with disabilities. But if they have made sure that the building is comfortable for them, and they can access things easily, they will qualify for this tax credit.

DID YOU KNOW?

United Arab Emirates (UAE) is the world’s richest tax-free country, with a GPT of $414.2 billion.

Credit for Paid Family and Medical Leave

Firms that offer paid leave for family or medical reasons can get their tax reduced because they can apply for tax credits. Their consideration towards their employees is a good sign, so they are usually granted it.

Research and Development

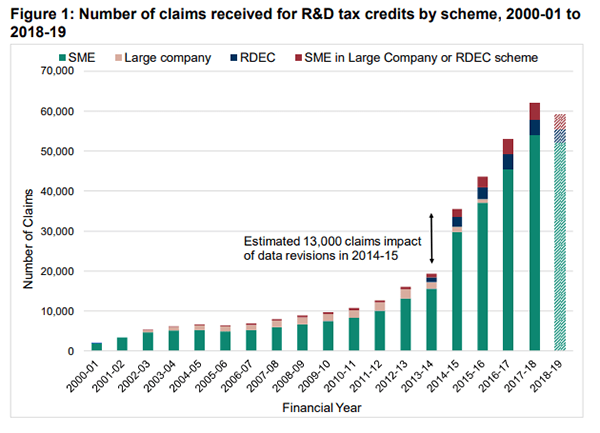

This one is a bit tricky as you have to prove that your brand has been engaged in R&D. Startups and small businesses require funding and if you are related to something that will benefit society then you might be awarded it.

In the statistics below, you can see the growth in R&D tax credit between 2001-2019.

How to Claim Tax Credits

Now that you are aware of all these tax credits, you should know how you can claim them. Here are a few ways to do so:

Identify Eligibility Credits

Since you’ve read about different types of tax credits, you should identify those your small company is eligible for. You can conduct some extra research just to be on the safe side and gather all the essential documents as proof.

Consult a Tax Professional

It’s the best option as it reduces your chance of making any mistake. You can consult a professional and show them your paperwork, and they’ll give you better insights and tips that will help you.

Complete the Necessary Forms

Several forms need to be filled out if you want your tax credit to go through. Pay attention to every detail, as one wrong thing can cancel out your application. Take professional help here as well.

Common Mistakes to Avoid

There are a few common mistakes that small business owners make while filing for tax credits. Just so you don’t, I’m mentioning them here:

Missing Documentation

This could happen to anyone, that’s why before filling out the final draft of every documentation, double-check it to make sure that you are not missing anything.

Not Seeking Professional Help

As mentioned earlier, seeking professional help is a must as they will tell you things that will work in your favor and give you better guidance. They’ll be able to tell you what forms to fill out and might even do that for you.

I told you all the essential details regarding tax credit and how you can claim it as a small business owner. It will help your establishment save up money as the government will assist you. You should utilize it.