“Tax complexity itself is a kind of tax.”

– Max Baucus (Former United States Senator)

It doesn’t take long for the fond memories of Christmas and New Year’s Eve to fade away and turn into a growing pit in your stomach, well the credit for giving rise to this anxiety goes to “The tax season.”

To be honest, it is not surprising to learn that 56% of Americans have a negative reaction towards taxes, with 26% of them saying that they hate it. (Pew Research Center: Income Tax Reports)

After all, it is not easy to understand and navigate through the tax filing procedure.

Some of you might not believe it at first, but trust me, it only takes a little forethought to turn this complicated tax operation into just another mundane chore. Want to know how? Read to the end and learn all about it in this article.

Get It Over With Early

Putting off filing your taxes until the last minute will not make anything easier, instead, it is one of the worst things you can do during tax season. It is a wise move to start preparing as soon as you receive your P60 or any other relevant forms you need for your tax return, rather than scrambling to find receipts in April.

This way you will have more time and opportunities to review everything thoroughly and save you from standing in long queues with other last-minute filers.

Additionally, early preparation allows people to identify potential deductions or errors, ensuring they maximize their refund or minimize their liability.

FUN FACT

The federal tax code is more than 70,000 pages long, growing from 400 pages at its birth in 1913. That’s enough sheets to wallpaper the outside of the Washington Monument.

Be Organized

Develop the habit of collecting all relevant receipts, business expenses, charity donations, and miscellaneous tax deductibles. To streamline this process, use a twofold filing system, with physical and digital folders for each category, this will help you complete the return more quickly while ensuring you don’t miss anything important.

These small habits and a little diligence throughout the year can save you from all the confusion and complications, once tax season comes around.

Stay Informed

It is not rare to hear about some new tax updates, being up-to-date with these latest changes in the tax system saves a lot of unnecessary frustration and hassle, especially for people having several income streams or unusual circumstances.

For this, you can trust the HM Revenue & Customs (HMRC) to speed up and provide in-depth analyses and the latest information on a broad range of tax-related subjects.

Staying educated about these changing laws also means knowing approximately when you might receive the P60 form, the filing deadline, and the relevant documents you can expect to collect year-round. To further simplify things, consider creating a tax calendar to keep track of this information better.

Consult Last Year’s Return

Those of you who are not filing taxes for the first time can already streamline the process for this year by referring to the previous one. Last year’s return will help you better set expectations, and they can even remind you of expenses or deductions you might have neglected otherwise.

Use Tax Filing Software

Thankfully, we have come too far from the times when you had to spend sleepless nights going through heaps of papers to make sense of tax returns. Now, plenty of excellent tax software options are available in the market to assist you with various taxation elements.

Doesn’t matter if you require premium offerings with guided questionnaires and 24/7 customer support, or some free alternatives that might not have all the bells and whistles but can still help tremendously, tax management software can provide it all.

In all this, do not forget that these services handle your sensitive tax information, hence protecting your account should be your top priority. Ideally, you should generate strong, unique passwords for these and any other accounts related to your finances with a trustworthy Windows or Mac password manager.

Moreover, secure them using the manager’s built-in two-factor authentication feature to get instant notifications in case of potential breaches and stop compromised passwords from being enough to access your accounts.

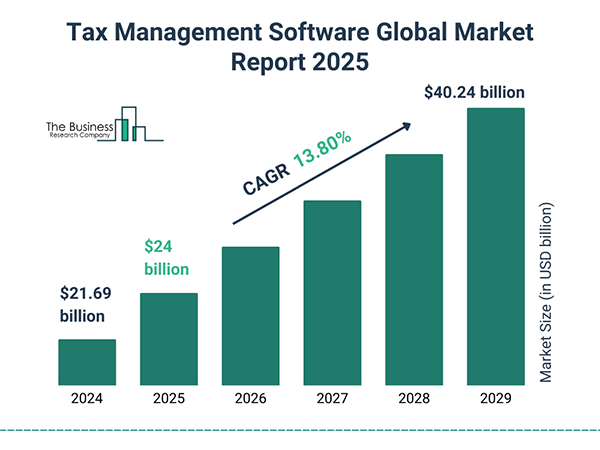

While we are on the topic, the tax management software global market is on the rise and is projected to grow at a CAGR of 13.80% and reach $40.24 billion by 2029.

Beware of Online Threats

It is no secret that phishing efforts see a tremendous increase around tax season. A common trick used by cybercriminals is to send phony emails mimicking filing services or tax authorities in hopes of stealing your private data. Hence, it is necessary for everyone to know what phishing scams are and how to guard yourself against them.

Email masking is one of the most trusted ways to prevent phishing. Often included with password managers, it allows you to create accounts separate from your personal email, securing your main address by keeping it private and significantly reducing the risk of phishing and identity theft.

It also minimizes spam and makes it much easier to track anyone having access to your sensitive information, providing extra protection during tax season.

Consult a Professional

Despite various attempts to simplify things, the UK tax system remains complicated and unintuitive for an average taxpayer. Fortunately, in the current times, we can take guidance from professional self-assessment tax return services, which can help you navigate the pitfalls.

I know it might seem like an expensive solution to some, but trust me, consulting tax outsourcing services regularly pays off in multiple ways. They can inform you of new deductions and credits, help you proactively make positive tax decisions throughout the year, save you from legal troubles, and, most importantly, give you peace of mind.

In conclusion, filing taxes can be complicated for an average person, especially if they do not belong to a related field. Still, they can significantly streamline this procedure if they start early, keep their financial statements organized, and stay updated with the changing laws.

To further simplify things, you can take assistance from a tax management app or consult a professional. These small tips can save you from last-minute complications, delays, and errors. Also, be aware of the online threats that are known to increase during the tax season.