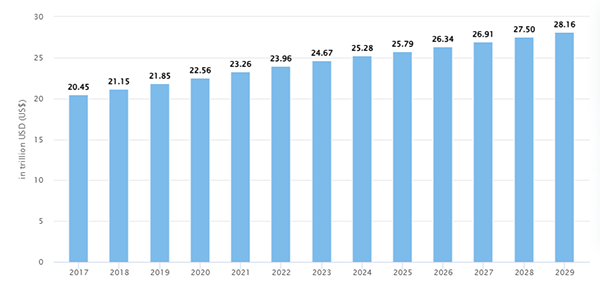

Do you also find buying places for your enterprise too expensive? Businesses are increasing at a rapid rate, and to cater to this huge number of organizations, new offices, and buildings are built to lend out commercial spaces. This whole market of commercial leasing is expected to reach the mark of $24 trillion in 2024 (Statista).

The reason this option is so popular is that buying a property for commercial purposes is too expensive for organizations. Purchasing a space only for a few professionals might be a good idea if the firm has various resources to cater to, or to buy a massive area for a factory or plant. Alternatively, leasing emerges as a more viable option.

So, if you are also a business owner like me and can’t decide why leasing is a great option, consider reading the article till the end.

What is a Commercial Lease?

In simple terms, when you pay for temporary ownership of a commercial place instead of a residential one, it is called a commercial lease. These properties hold a critical value for a major chunk of businesses currently operational.

Although I am trying to explain commercial real estate (CRE) in the minimum words possible, the concept is actually much broader. There are different types of CREs, valued at various prices, and used for various purposes.

Further, I will let you explore all these dimensions in the simplest form possible.

Types of Commercial Leases

Commercial leases are available in different types that suit all business owners. Usually, middlemen like Brisbane mortgage broker and professionals are there to help you with the process. However, still, you need to have a basic idea of operations. So, the following are some types of leases you must know about:

- Gross Lease: Probably the simplest option to pay a lease, gross lease only demands the lease amount from the tenant, and the rest of the property tax, maintenance, insurance, etc. is paid by the landlord.

- Net Lease: In a net lease contract, the tenant is expected to pay all (or mentioned) operational costs of the property.

- Modified Gross Lease: A mix of gross and net lease, modified gross lease makes the tenant to pay for the base lease and a portion of the operational cost as mentioned in the contract.

- Percentage Lease: Along with the base pay of the lease, the tenant also needs to pay a percentage of their revenue through their sales or any other operations.

Key Components of a Commercial Lease

When signing a lease for any commercial property, it is necessary that you focus on each element to avoid any misunderstandings in the future. So, the following are those elements or components of the lease that you must emphasize:

- Lease Term: The lease term is necessary for you to know because it is the time that you are allowed to spend on the property. It usually stays between the commencement date and the expiration of the lease term.

- Rent and Payment Terms: This section includes all the necessary details about what you have to pay to the landlord along with the rent. It includes rent, security deposit, payment schedule, late fee, etc.

- Use Clause: To stay legally safe from any malpractices done on the property, the use clause specifically mentions the purpose for which the property is being used for business offices.

- Maintenance and Repairs: All the maintenance and repair terms are discussed in the contract. Whether it is going to be paid by the landlord, the tenant, or both, every detail is mentioned in this section.

- Security Deposit: Also known as a “rent deposit”, the security deposit is paid to the landlord to insure for any potential damage or to secure the lease agreement.

- Termination Clause: As the name suggests, it simply discusses the time when the lease is going to be terminated.

- Assignment and Subletting: In simple words, “assigning” deals with transferring the roles and responsibilities to another party. Whereas, “subletting” lets the tenant further hire a subtenant, making him act as a temporary landlord (on the owner’s approval).

Negotiating a Lease

Despite plenty of property operations, you must explore different lease providers and negotiate terms to squeeze out the most value. Here is how to master the negotiation:

Understand Market Rates

Start by running research over the internet about what are the current market rates. The price of at what rate the property can be leased is expressed by the price per square foot. The duration of the payment may vary per month or per year.

This price keeps on fluctuating and changing across the locations, economic conditions, and with changing supply and demand.

Request Customization

If you think the property is appropriate for what you need, but the prices or terms do not fit right, you must make your efforts to customize the lease deed. Surely, there would be some compromise that needs to be made, but try to make the deed as profitable and fruitful as possible.

Clarify Responsibilities

The lease deed must explicitly define all the responsibilities of T&C that both parties (lessor/lessee or landlord/tenant) are bearing. These responsibilities may be of any type related to maintenance, operations, etc.

The responsibilities must be made clear beforehand and mentioned precisely in the document.

Common Mistakes to Avoid

A commercial property lease is undoubtedly a great option to go for, but it can also become a headache if you make the wrong decision. To make sure that you are opting for the right deal, avoid the following mistakes:

- Read all the terms and conditions carefully

- Consider the location of the commercial property

- Inspect the property you are going to lease

- Negotiate terms and conditions

- Consider the right size and shape of the property.

Lastly, if buying a commercial property is a major expense your company funds can’t bear, leasing it out is the next best option you can go for. So, follow the guidelines as mentioned above, and find the right property at the right prices.