It is an emergency fund for unexpected costs, essential for financial stability and peace of mind.

Did You Know?

According to the Federal Reserve’s 2023 Survey of Household Economics and Decision-making, 37% of U.S. adults would not be able to cover an unexpected expense of $400 using cash or equivalents, highlighting a widespread lack of financial buffer against life’s inevitable emergencies.

Life has an uncanny way of throwing unexpected curveballs – from sudden car repairs to unforeseen medical bills or a broken essential appliance. These financial surprises aren’t just inconvenient; for many, they can trigger a cascade of stress and debt.

The above statistic underscores a critical truth: a “rainy day” fund isn’t a luxury item or a minor convenience. It’s the absolute foundation for navigating adult life with a sense of security and peace of mind.

They simply arrive, demanding immediate attention and funds. This article will explain why building and maintaining your emergency fund deserves the highest respect, acting as your essential shield against financial chaos.

KEY TAKEAWAYS

- A “rainy day” fund is a fundamental necessity for financial stability, not only a luxury.

- Unexpected costs appear without warning, regardless of your budget.

- A safety net prevents anxiety, shame, and Reliance on credit cards or borrowing when emergencies strike.

- It protects against both major disasters and smaller ones, saving expenses that can drain finances.

- Building this fund offers a profound sense of control and peace of mind, transforming issues into problem-solving.

- Don’t aim for perfection, start saving any amount regularly and consistently to keep the fund separate from spending money.

- Your emergency fund is strictly for uninvited expenses, so avoid using it for non-emergencies or regular spending.

Budgeting Without a Safety Net Feels Like Holding Your Breath

We all know how hard it is to breathe when every unexpected cost feels like a financial punch in the gut. And when you don’t have a backup plan, even small problems feel different.

You’re not just paying for the thing; you’re paying in anxiety, shame, and putting things off while you “figure it out,” which usually means borrowing from rent, juggling credit cards, or ignoring your bank notifications. This is not resilience. This is survival mode. And it’s exhausting.

Emergencies Aren’t Always Loud. Sometimes They Creep In.

Emergency funds are generally considered for major disasters: job loss, medical emergencies, flooding. But it’s the slow leaks that drain you first.

An unexpected co-pay here, a last-minute flight there, or your kid’s school activity that somehow costs $200 even though you already pay tuition. These aren’t highly publicized emergencies, but they chip away at your sense of control.

Additionally, when you don’t have the reserve funds to soften the blow? You may turn to limited-term solutions like credit cards or services such as CreditFresh to help bridge the gap.

INTERESTING FACT

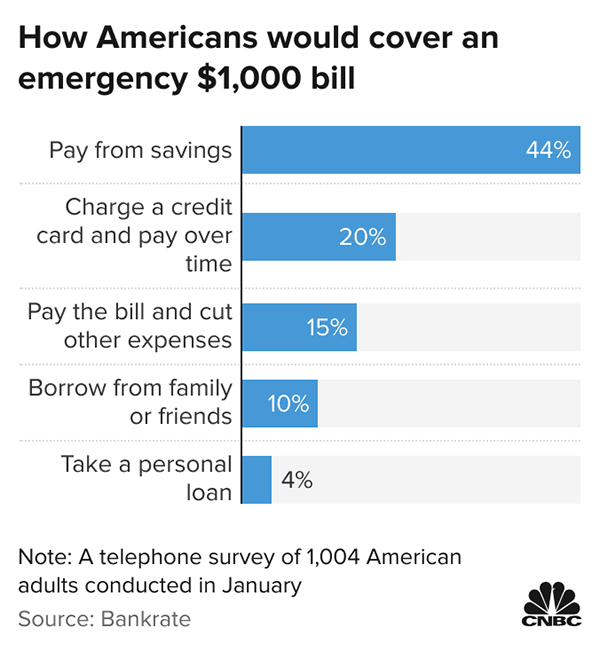

Approximately one-third of Americans face an unexpected expense of $1,000 or more each year, underscoring the frequent need for readily available emergency funds.

Why Building a Buffer Feels Emotionally Bigger Than It Is

People don’t communicate about the emotional weight of saving. Especially when it feels like every dollar is already being asked for. But an emergency fund isn’t only about being “good with money,” but it’s about control. This is the difference between scrambling to cover a car repair and calmly transferring funds from savings.

It’s the serene moment when your job gets cut, your tooth cracks, or your pet needs surgery. In case of a fallback, it is your Plan B. Your “thank god I planned for this” moment. If you’ve not yet built one before, this government guide to setting up an emergency fund is a superb place to start.

You’re Not Bad with Money. You’re Just Stretched Thin.

There’s a false belief that not having a safety net means you’re not careful with your money. More often than not, it means you’ve been putting other people’s needs ahead of your own.

Even your income doesn’t keep up with your life, or you’ve been playing catch-up for so long that you’ve forgotten what stability feels like.

This isn’t a flaw; it’s a sign that it’s time to reclaim your buffer, not for some future time, but for the version of you who will need it in two weeks when your fridge breaks down, and you still haven’t been paid.

Start Ugly. Stay Consistent.

Do you know the biggest myth about emergency funds? It is that you need to build them perfectly.

You don’t.

Start getting messy, throw in $25, transfer a tax refund, or automate $10 a week, make sure to hide it from yourself in a separate account. Forget fancy spreadsheets and optimizing for interest rates; just get the money out of your spending path. If you need assistance structuring a savings habit, this Savings Fitness workbook from the U.S. Department of Labor is encouraging and not soul-crushing.

Keep the Fund Boring, Not Tempting

The most foolish thing you can do with your rainy day fund is to treat it like a wishlist account.

This money is not for Black Friday, it is not for last-minute concert tickets, or impulsive getaways. Again, it’s not for “deserved treats” or lifestyle upgrades.

It’s for life’s unexpected curveballs, and there will be more than a certain number.

Final Word: You Deserve a Buffer Between You and Chaos

You only need to decide that you’re done living, one unexpected crisis away from a crisis.

Treat your rainy day fund as though it were a boundary because it’s what’s keeping you from having sleepless nights, financial ruin, and the version of yourself that doesn’t have to freak out when things get messy.

Start now, even if it’s only a small amount. Especially if it’s only a little.

- Budgeting Without a Safety Net Feels Like Holding Your Breath

- Emergencies Aren’t Always Loud. Sometimes They Creep In.

- Why Building a Buffer Feels Emotionally Bigger Than It Is

- You’re Not Bad with Money. You’re Just Stretched Thin.

- Start Ugly. Stay Consistent.

- Keep the Fund Boring, Not Tempting

- Final Word: You Deserve a Buffer Between You and Chaos