Coding is becoming important in trading and quantitative analysis, but it is still not a necessary requirement to learn coding skills in investment banking.

Key Takeaways

- Investment banking is a skill that is built through hands-on practice, not just by theory.

- Mastering models helps you understand the puzzling numbers and the real story behind companies’ work.

- When you learn to navigate the M&A structure, it can protect every financial move.

- If you have a smart idea that needs to be presented in front of everyone, it can boost your confidence and credibility.

- Strategic training and teamwork make you think clearly, and sharing ideas with each other builds a strong network.

- From AI to technical tools, you need to learn every changing subject.

- By staying calm, you can level up your performance to make the right decision and build a relationship with clients.

Since more people are understanding the need for financial management, the demand for investment banking is growing. According to the reports, the global investment banking market price was estimated to be over 380 billion dollars. (Source: Fact.MR)

As a result, it is opening opportunities for the younger generation to start building a career in investment banking. It can be done by using the right guidance to earn a huge profit. Perhaps a deep understanding can be rooted in learning the investment banking theories and practicing them without risking money.

Are you still confused about how to learn bank tactics without risking money? Roll your sleeves up and scroll through this article. This written guide will help you comprehend the depth of investment banking.

The Power of Learning by Doing

Even if you are born with a silver spoon in your mouth, you need to practice money-saving techniques to keep your assets maintained. In investment banking, it is easy to know the theory, but hard to apply.

Learn here how practical training boosts investment banking skills:

- You can apply financial theories to real-world scenarios.

- It helps to make quick and mindful decisions under pressure.

- Through it, you can learn from mistakes without feeling guilty about the consequences.

- Lastly, people gain confidence in their abilities before entering the real trading field.

Like you can’t swing just by watching a YouTube video, similarly, knowing only theory won’t work itself. Therefore, you should practice regularly to apply the learnings effectively.

Mastering the Art of Financial Modeling

Financial modeling is the most important aspect in investment banking. By mastering this art, you learn to build various management skills.

As you gain expertise, you develop the ability to build complex finance models from scratch. Along with this, you can analyze company financials and market trends to project possible cash flow and valuations.

In the right banking environment, aspiring bankers continuously practice developing financial models. Additionally, this proactive practice helps in building their ability to generate accurate and desired outcomes.

Navigating Deal Structures and M&A Scenarios

Progress doesn’t end with achieving an ace in financial modeling; you need to deal with structures as well as mergers and acquisitions (M&A). The investment banking method helps participants to:

- Perform duties as both a buyer and a seller.

- Negotiate terms and valuations like a pro.

- Fulfill due assessments on specific companies.

- Last but important, work according to the legal and regulatory aspects of M&A.

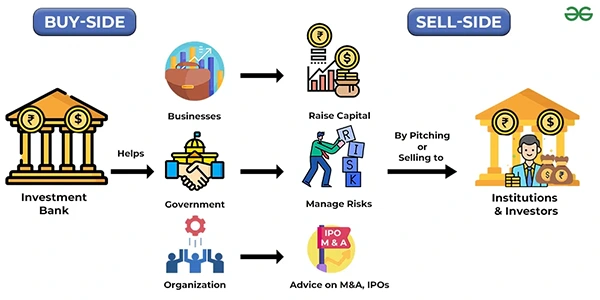

The image below tells about the role it plays on the buyer’s side and the seller’s side.

One wrong move can ruin the deal, so it is crucial to learn strategies that can help in dealing with structures and M&A scenarios.

Honing Presentation and Pitching Skills

While doing banking, it’s not beneficial what you know, but what you can deliver. That’s where you need to present your skills in front of your mentors.

Check out the following things before presenting:

- Create compelling investment pitches, highlighting your ultimate target.

- Make sure to attach the financial analysis to add credibility to your work.

- Defend your ideas in front of clients using strong counterpoints.

- Last, but equally vital, improve your public speaking skills to stay confident.

Remember that confidence is the key, and the above exercises support nurturing it. If you get negative feedback, don’t set down your belief; instead, take it as constructive criticism.

Developing a Strategic Mindset

Banking is not only about handling money–it’s about targeting big goals. It simply means shifting from short-term goals to long-term achievements by presenting complex market scenarios.

What does it typically include?

- Thinking beyond the present scenarios and implementing decisions according to the outcomes.

- Finding innovative solutions for the puzzling market conditions.

- Minimizing the risk and achieving the reward.

- Also, using different financial tools to implement strategically.

Building Teamwork and Communication Skills

The earliest step towards investment banking is to commence networking. It can open up a set of opportunities to establish a banking career.

With a cooperative environment, you can easily do the following things:

- Work with people with different ideas, which can offer many choices.

- Everyone can share responsibilities and support each other.

- Communicate clearly to break down the complexities of subjects.

- Offer constructive feedback that can promote the growth of every individual.

It’s saying that teamwork makes the dreams work, so everyone can collaborate and show a sense of community to build their skills.

New technology and fresh thinking—that’s what we’re all about.

The financial industry’s landscape is not limited to calculators and spreadsheets. With the advanced integration of artificial intelligence, data, and tech equipment, we have made a game-changing move.

In this way, training now includes:

- Incorporation of smart systems to analyze huge amounts of data quickly.

- Learning about cryptocurrency and blockchain may lead to enormous banking investments in the future.

- Understanding financial technology, such as UPI’s QR code payment system.

- Lastly, using technology for making better decisions and implementing them to get positive outcomes.

By seeing the changing world in terms of technology, we predict that in the near time bankers will become tech wizards.

Managing Risk and Compliance

There is no way you are investing in something and have no risk. One slip can make you fall harder, particularly in the case of big data.

Here is what you have to work towards:

- Think of a real-life crisis as if you fall into a market crash to prepare your brain to get used to it.

- Keep analyzing banking rules and seek how to follow them.

- Prioritize ethical choices to ensure legal safety even when you are under pressure.

- Finally, learn the changes in laws and dealings that can keep banking safe.

The above suggestions are for you to implement in life to build your inner compass for knowing not just what you can do, but what you should do.

Cultivating Client Relationship Skills

Investment banking is not about solving numbers, but also building trust, just like a patient has in a doctor. You need to listen, understand, and care for your clients.

While learning investment banking skills, you go through:

- Understanding your client’s needs using a transparent conversation and then tailoring your advice accordingly.

- When things go south, you need to handle tough conversations by staying calm and mindful.

- It is important to build trust by keeping promises and conversations confidential.

- Try to solve problems efficiently and keep the relationship strong.

Remember that your clients won’t pay attention to your spreadsheets, but they will definitely remember their experience with you.

Interesting Fact

“The United States is known to be a financial powerhouse worldwide due to its excellent career growth and compensation as an investment banking professional.”

Adapting to Market Volatility

Investment markets are volatile and change faster than the weather. Note down the simulation taught by Finsimco:

- Don’t panic when you observe sudden market flips; just respond quickly to prevent any financial loss.

- Change your strategy according to the requirements, similar to changing gear on our steep hill.

- Maintain the composer, enter pressure, and trust your training.

- Decide quickly, even with limited information, because you may not find the entire sheet.

Keep in mind that theories can be learnt from textbooks, but skills are acquired through regular exercise.

Measuring and Improving Performance

Practicing is not the last stage in investment banking; it also involves measuring and improving performance timely manner. The following steps guide on how to effectively prepare a framework:

- Include detailed reports and their effective outcomes.

- Make sure to compare the performance with peers to determine where you stand.

- Create a personal development plan based on the results to improve.

- In the end, do not give up on practicing again and again until you shine.

In banking, your results speak louder than your time, environment, and experience. That is why it is important to show your skills incredibly.

Conclusion

The realm of investment banking is critical as well as complex. That’s where practical training and simulation help future bankers to grow and learn without risking real finance.

Using effective management and marketing strategies, anyone can be on the list of top bankers. Overall, the whole article suggests that practice doesn’t only make perfect, it can make profit too.

- The Power of Learning by Doing

- Mastering the Art of Financial Modeling

- Navigating Deal Structures and M&A Scenarios

- Honing Presentation and Pitching Skills

- Developing a Strategic Mindset

- Building Teamwork and Communication Skills

- New technology and fresh thinking—that's what we're all about.

- Managing Risk and Compliance

- Cultivating Client Relationship Skills

- Adapting to Market Volatility

- Measuring and Improving Performance

- Conclusion