“Any informed borrower is simply less vulnerable to fraud and abuse.”

— Alan Greenspan, former Chair of the Federal Reserve of the United States

Fraud poses extreme risks to businesses, ranging from financial setbacks to damage to trust and reputation. Unfortunately, with each day passing, only an increase in such cases has been observed. So much so that 95% of businesses reported experiencing identity fraud within their organization. (Regula: Identity fraud statistics)

These statistics are not only scary but also a wake-up call for businesses to leverage modern tools and better strategies to guard against fraud and comply with legal requirements.

But how to establish and implement strict practices to identify genuine customers to prevent identity fraud? If you are also looking for an answer to this question, this article is for you. Here, we will discuss four effective practices for customer data validation and to assess new clients accurately.

Identify Verification

By confirming a customer’s identity, you can prevent unauthorized parties from acting on someone else’s behalf, creating fake identities, or committing fraud. For this, identity verification is the key. It serves to confirm that an individual is truly who they claim to be.

Consistently verifying identities minimizes the risk of certain organizations or services being targeted due to weaker checks, ultimately decreasing chances for identity fraud overall.

But remember that verification relies on both physical and digital evidence, for instance for passports or secure database records, which must be thoroughly authenticated to detect any falsifications.

By accurately verifying identities, organizations can confidently provide access to the right people, safeguarding both their processes and the individuals involved.

Utilize Identity Verification Tools

Since businesses handle thousands of customers, it can become a bit challenging and complicated to have to manage it all. This is where software to verify the identity comes into play, it helps businesses ensure:

- The true identity of their users.

- Address the challenges posed by the simplicity of creating fake profiles online.

- Help bridge the gap between digital interactions and real-life authenticity.

Some of the common methods that you can introduce in your system include secure sign-ins, personalized questions, or video identification. By working together, these can safeguard businesses from fraud while fostering customer trust.

Also, it is best to choose a provider who can adapt swiftly as fraud tactics evolve, as it can help maintain both security and confidence in your operations. MRZ OCR scanners check all the boxes and can be leveraged to extract and verify data from identity documents, while technologies like facial recognition and fingerprint sensors can be used for biometric verification.

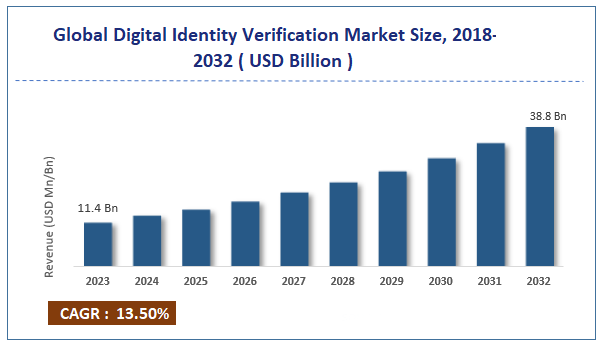

While we are on the topic, the global identity verification market is on the rise and is projected to be valued at $38.8 billion by 2030.

Regularly Review Financial and Credit Reports

Unlike credit card fraud targeting individuals, business credit fraud has the potential to impact multiple employees and even tarnish a company’s reputation.

You may not know this but fraudulent activities can even go unnoticed if not monitored closely, this is because fraudsters don’t require physical access to business credit cards to execute unauthorized transactions.

To identify any unfamiliar changes early, make sure you review your business credit card statements routinely. This will help you mitigate risks at the right time before they turn into a bigger issue.

You can utilize online banking tools for regular and detailed checks to simplify this process. Additionally, you can strengthen your defenses by updating passwords frequently and staying alert when processing orders. Any suspicious activity should be promptly reported to your credit card provider to alleviate risks effectively.

DO YOU KNOW?

On average, companies face more than 30 identity fraud cases per year.

Anti-Money Laundering

Anti-Money Laundering regulations encompass a range of measures, including:

- Helping banks/businesses identify and prevent the flow of illicit funds being disguised as legitimate ones.

- Safeguarding the financial and reputational integrity of organizations.

- Making it harder for criminals to commit such crimes.

To effectively detect unusual transactions and manage money laundering risks, financial institutions must develop advanced customer due diligence strategies and stay updated about the evolving AML requirements.

Since AML and Know Your Customer (KYC) standards are constantly changing, staying compliant often presents challenges but is essential for maintaining trust and security.

EndNote

In the end, it can be said that as technology evolves, fraudsters are finding new ways to exploit it and coming up with more sophisticated ways to perform their actions. That is why it is essential for businesses to stay alert and regularly update their identity verification procedures to outpace potential risks.

By following the recommendations shared in the article above, you will be able to create a safe and secure environment in your company for both your staff and customers, and also maintain trust and a positive reputation.