Provides clarity as to the registration of assets, financial statements, and net worth determination, asset valuation, and current and future tax issues.

KEY TAKEAWAYS

- It is essential to check the experience of the CPA before hiring one.

- Matching his area of knowledge and qualification according to your requirement is necessary.

- Hire a CPA who stays updated with all the IRS Rules and all the Laws.

- After shortlisting, research about their reputation and professionalism.

- Conduct some interviews to get an idea about their corporation process, knowledge, and quality of communication.

When it comes to managing your finances, selecting the right CPA becomes very important for both individuals and businesses. A good real estate CPA can help you structure your business and stay on top of the income and expenses to minimize potential taxes and maximize ROI. You can learn more about the significance of a CPA in real estate here: https://www.forbes.com/sites/forbesbooksauthors/2025/01/20/the-top-tax-benefits-of-real-estate-investments-in-2024/

A specialized CPA will also simplify complex tax matters for you and help you discover maximum savings opportunities. The only thing is you may not have worked with these professional CPA, so the process of actually finding the right one for you can be a bit confusing.

But we are here for you. Read more about 6 amazing tips on finding the right CPA for your real estate, in this article.

Start With Checking Their Experience

Once you identify some potential candidates through online searches or recommendations, you need to start the process of hiring the right CPA by verifying their real-world experience.

It is not enough for you to simply find and hire a CPA. Instead, you have to find and hire a CPA who specializes in real estate, and that, therefore, has a lot of experience working in that industry. This is how you will ensure that they understand precisely what you need, and that they will be able to meet those needs for you.

Check Their Qualifications

Keep in mind to check the qualifications. You want them to be licensed and highly knowledgeable in this particular line of work. So, take time to find the info you need about this on their official sites, or perhaps even inquire about it directly when you start getting in touch with potential candidates.

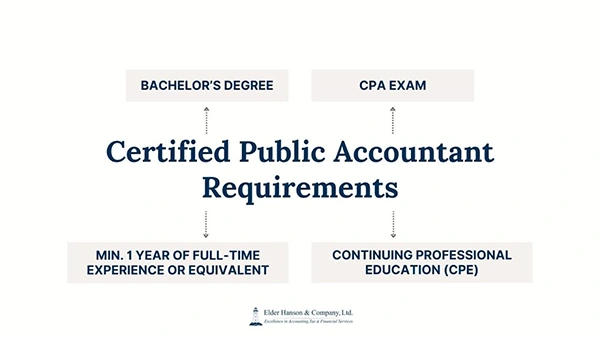

The bottom line is that you want to hire qualified CPAs for this. Here is a chart you can use to identify whether they are qualified or not.

Check If They Are Staying Up to Date With All the IRS Rules and All the Laws

Moving on, you also want them to always be up to date with all the real estate laws and all the IRS rules and regulations. This way, you will know that they will be doing everything by the book, thus helping you save money, while also ensuring that you are complying with all the rules.

This will also ensure that you won’t get into any trouble because of breaking or ignoring any law. As this question is very important, you can ask it directly.

Remember That Reputation Matters

Naturally, you should remember that reputation matters significantly as well, and you should, thus, always aim at hiring highly reputable and reliable professionals.

So, when you come across Advise RE or similar great companies, take your time to check everything they have to offer, and then proceed towards inspecting their reputation. You can do that through reading reviews written by their previous clients.

DID YOU KNOW

Christine Ross was the first woman CPA in the US. She received her New York State CPA certificate in 1899.

Have Some Interviews

It goes without saying that you should have some interviews with the pros you’re considering. Those will serve two purposes. For one thing, you will get to ask any questions you have about the cooperation process, qualifications, and anything that seems important to you to ask them, and get the important answers you need.

For another, you will get to actually assess the quality of communication, since you absolutely want to hire CPAs that you can easily communicate with, and that will be ready to answer all your inquiries respectfully.

Compare All the Findings and Choose

Finally, once you are done with the entire research process, there will only be one thing left for you to do. In short, you should compare all the findings. And then, make your final choice, and start saving money on taxes with a great CPA specializing in real estate on your side.