Did you have any idea that over 422 million people were affected by data and privacy breaches in the US in 2022, according to a report by the Identity Theft Resource Centre?

With everything being digital, online investments, UPI services, and sharing details over calls have become the norm; financial data has been more than exposed. Every single sign-up for free or filling in your details to win a prize can be a well-planned trap. It can help data brokers track your financial records and collect sensitive data.

So, users are increasingly searching for tools that can help them remove personal information from the internet. Hence, we are here to shed light on one such platform – Incogni, which can keep you kilometers away from such traps.

Why Data Privacy is Crucial in the Financial Sector?

As we all know and can see in the current dynamics, digital finance is making waves already, so maintaining financial privacy isn’t just a concern anymore – it’s a necessity.

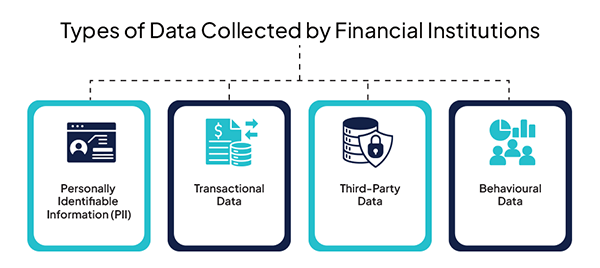

Because, unlike browsing history, financial data is extremely personal. It can reveal your credit history, banking patterns, insurance details, investment plans,

The potential misuse of the data is way more than we can even think; it can go from discriminatory lending practices to identity theft and financial scams. Therefore, if your financial data is in the wrong hands, the impact is immediate and deeply personal.

The government is taking fruitful measures to cover the barrier and build awareness, but still, there are a few challenges that may occur during the handling of financial services.

Common Privacy Challenges in Financial Services

Despite the regulatory measures like the General Data Protection Regulation (GDPR), the Central Consumer Protection Authority (CCPA), and others. There are still some major gaps that come out as potential privacy challenges. Here are a few of them mentioned:

- Many financial services collect more data than is necessary and store it with them in the long run. This increases the chances of getting your data vulnerable to the data brokers.

- Still, many users unknowingly agree to the terms and conditions and give consent to broad-sharing terms hidden in complex legal language.

- Mostly, the data you share with ‘partners’ or ‘service providers’ often ends up in the hands of data brokers.

- Even now, people have no idea who has access to their data or how and by whom it’s being used.

All these factors add to the risk of phishing scams, account breaches, or ransomware attacks, and it is easy to see why data privacy is no longer optional – it’s the need of the hour.

If you are not taking it seriously, the consequences can be severe, and it can result in great financial loss, which would take a lot of time to recover from.

How Data Removal Service Can Help One Out in Tackling Financial Privacy Challenges?

Even though regulations provide some protection, a proactive approach is essential, especially when it comes to personal functional data. This is where

This is where data removal apps enter the picture; it’s not a cybersecurity or data protection firm; instead, it works more like a data removal service that sends out opt-out requests to data brokers on your behalf.

So, if any third-party broker or service platform has ever compromised your financial security or if your information is regulated across multiple unregulated platforms, it can help you clean the slate.

It handles all the legal framework of contacting dozens (sometimes hundreds) of data brokers, and requesting the removal of your information from their databases. It’s like eliminating your digital footprints, but it removes any detail related to your financial records so they can’t be used by someone else.

Most importantly, you stay informed throughout the process without spending hours researching and manually submitting forms.

DID YOU KNOW?Starting in 2025, cybercrime can cost $10.5 trillion in financial loss annually!

Wrapping Up!

Financial data is the new frontier for privacy; from casual spending to formal credit inquiries, everything is logged, and if your data ends up in the hands of the wrong platform or broker, even routine information can be a threat to your identity and finances.

While financial institutions are slowly evolving to implement better privacy measures, your data often travels far beyond their systems. This is why individuals must take control and take immediate action if something feels fishy to them.

Using a service like incogni isn’t about achieving complete invisibility. It’s about reducing unnecessary exposure and reclaiming your digital autonomy. In a world where data is your currency, knowing who holds yours—and removing it when needed—is a powerful step forward.

It’s worth mentioning that you need to be precocious and not do anything that can harm you financially. So, be aware and keep tabs on where your data is being shared, and if it’s not necessary there, get it removed instantly.