Excess cash or fund is the amount that a business doesn’t require as they have already fulfilled all the requirements and all their operations cost has been covered.

KEY TAKEAWAYS

- Every business should have an emergency fund covering up to 6 months of operating expenses.

- High interest and money market accounts are a low risk investment options with great returns.

- Business CDs and treasury bonds provide steady long term growth.

- Clearing debt with the excess funds creates a balanced approach.

- Companies should open a brokerage account so they can start investing in stocks and ETFs.

There are times when businesses have excess funds, like cash or assets, which exceed their needs. It sounds like a good thing, right? Mostly, Life insurance companies fall under these categories, and the market cap globally is expected to reach $3.61 trillion in 2025.

While it might be considered as if the company is doing well, these funds need to be taken care of and used somewhere where it can multiply or grow over time. Suppose you have two cars but only need one. What would you do with the other?

A savvy person would make it available for renting where they can charge money. Now, their assets are being used, and they are getting some extra income. Just like that business’s excessive funds can also be managed, which would maximize returns, and I will tell you how.

How Much Extra Cash Should a Business Keep?

This is the first step: understand how much extra cash a business should keep before deciding where to store it. Having an additional fund is a good thing, but keeping it to yourself will lead to missing out on great financial opportunities.

Every firm needs to have an emergency fund that covers up to 6 months of operation expansion, and if they fluctuate during off seasons, 10–12 months would be recommended. They also need to consider their long and short-term goals.

They should only keep liquid cash if they have any upcoming major expenses, like buying equipment, expanding their reach, or paying taxes. But if none of it going to happen, the amount should be placed in higher-yield accounts or investments to maximize returns.

Balancing liquidity and growth is a challenge, but it can be achieved. Some businesses deposit it in an easy-to-access checkout accounts, but that doesn’t give any returns or leads to any investment. The surplus funds need to be used strategically, and in the next heading we’ll learn where those can be placed.

The Role of High-Interest Savings Accounts for Business Funds

One of the safest and most effective ways to store extra cash is in a high-interest business savings account. These accounts keep the funds accessible while also giving great returns on top of that.

These should be prioritized over traditional savings accounts that give nothing in return. Interest rates vary from bank to bank, so it’s important to do some research beforehand. Start by looking for competitive interest rates and comparing them.

Monthly maintenance fees might be charges, so banks with low charges needs to be chosen. The business world doesn’t remain the same, and who knows when one might need money, so it should be easy to access in case of any emergency.

Other Low-Risk Options for Storing Business Cash

Apart from high-interest business savings accounts, there are some other low-risk options as well. Including:

1. Money Market Accounts (MMAs)

MMAs give excellent interest rates, offers even better than high-interest business savings accounts. Apart from that, money can be withdrawn via checks or debit cards. It’s suitable for operators who are looking for limited but flexible access to funds and want great reruns.

But they might be requiring higher minimum balance requirements, so make sure to check the limit.

2. Business Certificates of Deposit (CDs)

A business CD gives you a fixed amount of interest for a set period, ranging from 3 months to up to 5 years. It gives competitive interest rates, but the money can’t be taken out until the maturity date. If individuals want to take out the fund before that, they’ll have to pay a penalty.

It should only be used by those who have spare cash and won’t be needing it anytime soon. Business Certificates of Deposit doesn’t include any market risk, making it a safe option. Also, if company owners want to withdraw the amount, what they can do is open several CD accounts with different maturity date instead of opening just one.

3. Treasury Bonds and Bills

Treasury bonds and bills are a safe government based investment option. These works like loans, and the U.S. government pays a fixed rate of interest over time. For the comparison, bonds are a long term investment with 10+ years of maturity date and gives periodic interest.

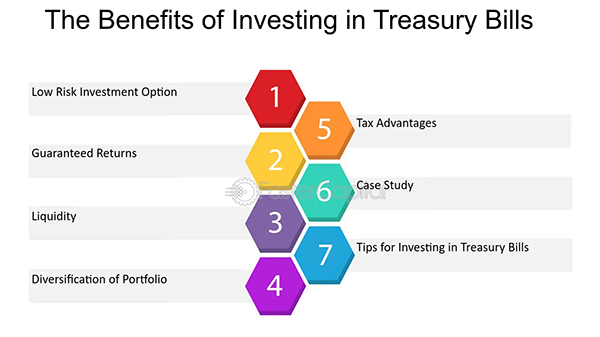

As for bills, it’s a short term investment running between a week to a year, and you get interest once the maturity date has passed. In the infographic below, you can see other benefits of treasury bills.

4. Brokerage Accounts for Businesses

The concept of brokerage account is quite straightforward, it basically allows companies to invest in stocks, ETFs (exchange-traded funds), mutual funds, and bonds. However, it does include market risk, but if you are fine with that and won’t be needing the fund anytime soon it could turn out to be a game changer.

But, never gamble by putting everything in one stock or mutual fund, instead spread it across different investment option that will make your portfolio better and protect you in case market crashed.

Strategy Based on Your Business Goals

Here are a few strategies that companies can follow based on their business goals:

1. If You Need Liquidity and Quick Access to Cash

If your business often requires quick easy to cash or liquidity consider putting the money in the highest interest savings account, not only it gives high interest rate, it keeps the funds accessible. This ensures in case of emergency or if any unpredicted expense arises, the company will have a backup.

2. If You Want Safe, Low-Risk Growth

Business CDs are meant for those who are sure they won’t need the excess amount for a while and want safe, low risk growth. Interest rates will make anyone gasp and is completely free from market risk. Since it’s backed up by government, there is no issue and individuals can just back and see their money grow overtime.

3. If You’re Focused on Long-Term Growth

Several companies are focused on long term growth and for them a business brokerage account is a must. It allows them to invest in low-risk stocks, ETFs, or bonds. It’s best suitable for those who are fine with calculated risk. While there is no fixed interest, returns can be skyrocketing depending on how good the market is doing.

4. If You Have Outstanding Business Debt

It’s a smart move to clear up any business debt with the excess fund, there are several benefits of it. Like:

- Reduces interest expenses.

- Firm’s financial position is improved.

- Cash flow is increased.

Creating a Balanced Approach

A balanced approach can be achieved by mixing up several different things. For starters clear up any debt that you might have and after that if there is still some fund remains put them in different account focusing on both long term and short term investments.

Market risk should be calculated, and some portion should be set aside for any unpredictable expenses. If any individuals work strategically, and mindfully, they can easily create a balance between earning good interest and securing the future of their business.

PRO TIP Diversify your investment by mixing low risk bonds and high interest savings!

Conclusion

Excess business funds are very useful and can help firms gain benefit in both long and short term period. Keeping them to yourself is not a smart move because it wouldn’t be growing, so it’s better to do some research and invest it in several places.

There are several options available, whether it’s treasury bonds or brokerage account, just find what suits your needs and can help you achieve new heights.