The four crucial pillars of this segment include feeding, breeding, weeding, and heeding.

In today’s innovative world, farms run on more than soil and sweat; they run on information. Farmers now have utilities to track seed costs, feed inventories, breeding cycles, and sales receipts across different systems, yet those numbers rarely connect.

The only drawback about these systems is that they are unable to show how these actions impact profit or loss. That loophole can cause numerous losses in the long run.

Research from the USDA shows that fragmented farm data can cut efficiency by nearly 20 percent. Modern agriculture is not just about growing or feeding—it’s about knowing.

But people who use integrated crop management systems can track all financial, crop, and livestock information into one system, and make decisions based on complete and current data.

In this blog post, we are going to explore more elements of these platforms and understand how these activities shape the financial health of the entire operation.

Let’s begin!

Key takeaways

- Understanding why integration matters

- Looking at the integration of farm accounting with crop planning systems

- Uncovering the solutions provided by livestock management systems

- Decoding the role of a unified ERP system

Why Integration Matters: The Backbone of Modern Farm Profitability

Farm businesses today face a constant balancing act: managing costs, predicting returns, and keeping operations running smoothly across various units. When crop data, herd performance, and financials sit in isolation, even the most diligent managers struggle to see what’s truly driving profits. Integration closes that gap.

1. Turning Operational Data into Financial Clarity

When your farm accounting software connects directly with crop and livestock systems, numbers start making sense. Input expenses like fertilizer, seed, feed, and labor automatically roll into cost-of-production reports. Instead of reconciling invoices at month-end, managers can track profitability per acre or per herd in real time.

According to the Farm Credit Administration, farms that adopt integrated digital systems report up to a 15 percent improvement in financial accuracy due to reduced manual entry and better cost attribution. That translates into faster decisions and cleaner books.

2. Eliminating the Guesswork in Cost Tracking

Without integration, it’s easy to underestimate the actual expenses of an operation. For example, a feed cost spike might look like a livestock issue when, in fact, it’s a result of rising grain prices on the crop side. Integration ties these costs together, giving financial teams context instead of raw numbers.

3. Building a Unified Source of Truth

Every department sees the same version of data—whether it’s a farm manager checking daily input usage or an accountant preparing quarterly reports. No more juggling spreadsheets or correcting duplicate entries. When data lives in one ecosystem, reporting becomes accurate, audits become faster, and financial visibility improves across the board.

4. Preparing for a Data-Driven Future

As agriculture becomes more technology-driven, integrated systems are no longer optional. They form the backbone of future-ready farms that rely on AI forecasting, IoT sensors, and automated reporting. Integration ensures that each of those technologies works off the same reliable financial foundation.

Interesting Facts

Crop health monitoring is the largest application, capturing 30% of the market share in 2025. AI-enabled systems are also used for weather tracking, irrigation management, and fertilizer optimization.

Connecting Farm Accounting with Crop Planning Systems

Crop planning drives every financial decision on a farm. The cost of seeds, fertilizer, and labor isn’t just an expense on paper; it defines how profitable a season can become. Yet in most operations, crop planning and accounting live in different silos. Managers plan inputs in one tool while accountants record expenses in another, and by the time those numbers align, the window to act has already closed.

When financial and field data work together, everything changes. Each adjustment in the field immediately reflects in the books. If a grower increases fertilizer application or shifts to a new hybrid, the accounting system updates those cost implications instantly. Instead of waiting months to see margins, decision-makers can review profitability by crop, by acre, or even by planting date.

Folio3 AgTech’s farm accounting platform is built to make this flow seamless. It connects field operations, procurement, and finance so that costs never get lost between departments. A fertilizer order raised in the ERP automatically communicates with the crop plan, and yield data from the harvest feeds back into financial reports. Managers don’t have to merge spreadsheets or guess which crop made money; the system lays it out clearly in one place.

Integrating Accounting with Livestock Management Systems

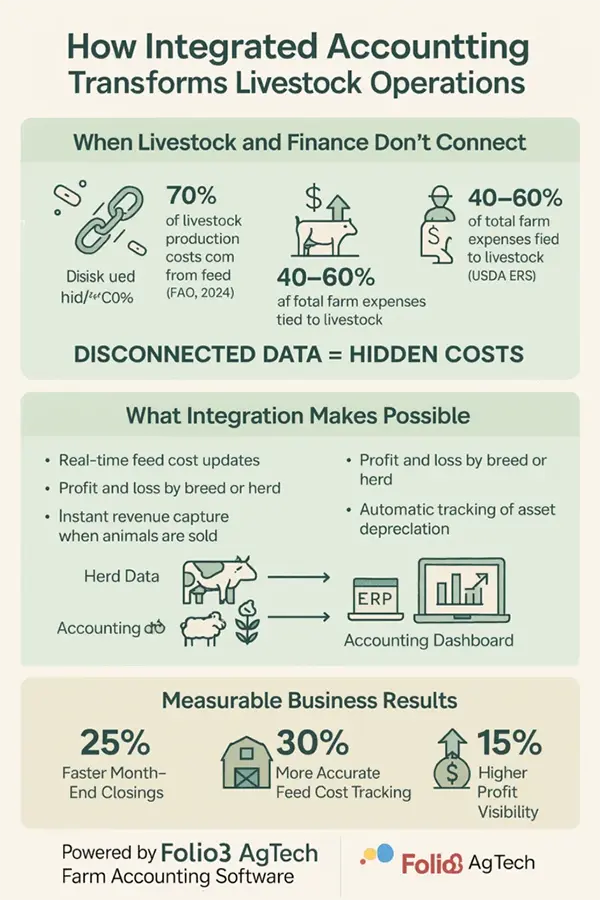

Livestock operations generate a constant stream of data — feed deliveries, breeding schedules, health treatments, and market sales. When these records sit outside the accounting system, it becomes difficult to measure the true cost of production or track profitability across herds. Integrating livestock data with farm accounting brings that clarity back.

The financial reality of livestock operations

• Feed costs make up almost 70 percent of total livestock production expenses, according to the FAO’s Livestock Report 2024. Even a small error in feed tracking can distort profit calculations.

• The USDA Economic Research Service notes that livestock can represent between 40 and 60 percent of a diversified farm’s overall costs. Without linking herd records to financial data, managers lose sight of where money is actually going.

• A McKinsey Agriculture Analytics Study from 2023 found that farms relying on manual entry and disconnected systems lose up to 12 percent of potential revenue every year.

What becomes possible with integration

• Real-time herd cost tracking, where feed, labor, and veterinary expenses instantly update in financial reports.

• Profit and loss visibility by breed, pen, or weight class to reveal which herds perform best.

• Automated recognition of revenue when animals are sold, aligning production and accounting instantly.

• Continuous visibility into asset depreciation for barns, equipment, and vehicles.

How Folio3 AgTech supports this shift

Folio3’s farm accounting solution links financials directly with herd management modules. Feed records, breeding cycles, and veterinary treatments automatically flow into cost analysis. When an animal is sold, the sale value, rearing cost, and resulting margin appear immediately in financial dashboards. Gone are the days when managers need to spend hours reconciling spreadsheets; they can now see real-time performance data that reflects both operational and financial health.

The measurable impact

Farms adopting integrated accounting tools have reported 20 to 25 percent faster month-end closings, a 30 percent improvement in feed cost accuracy, and around 15 percent higher overall profit visibility, based on Folio3’s 2024 internal benchmark data.

From Field to Finance: Building a Unified Farm ERP Ecosystem

Farms run best when data moves freely. Crop plans, herd records, and financial reports all describe different sides of the same business, yet most farms still treat them as separate systems. A unified ERP brings everything under one roof, so managers see the entire operation as one connected picture instead of fragmented parts.

In an integrated environment, every action in the field or barn automatically shapes the financial outlook.

- When crop inputs are purchased, accounting updates instantly.

- When livestock feed is logged, the cost flows into herd profit tracking.

- When harvest or livestock sales occur, the revenue appears in dashboards the same day.

According to a 2024 report by the AgTech Insights Council, farms that adopted unified ERP platforms achieved up to 28 percent higher decision-making efficiency compared to those using separate tools for operations and accounting.

Folio3 AgTech’s ERP framework follows this principle. Its modules for crop management, livestock tracking, and accounting are designed to share data in real time. A change in one area instantly updates the rest, removing the friction of manual entry or delayed reporting. That connectivity not only saves time but also gives leadership a true financial snapshot of how the farm performs each week, not months later.

Turning Data into Decisions: Key Metrics Farmers Can Track Through Integration

When operations and accounting run on separate systems, financial visibility becomes reactive — you only know what happened after the season ends. Integration changes that by giving managers a live view of how every expense, input, and yield impacts profit. These are the metrics that matter most once data starts flowing in one direction.

Cost of Production

Track costs by crop, herd, or enterprise unit in real time. Inputs like seed, feed, and labor automatically roll into cost-per-acre or cost-per-head calculations. Farmers can spot inefficiencies early instead of discovering them after harvest or sale.

Profit Margins per Unit

Integrated systems connect sales revenue with production costs, making it easier to see true margins per field or animal group. This helps in pricing decisions and resource allocation for the next season.

Feed and Input Efficiency

With feed accounting for nearly 70 percent of livestock production expenses (FAO Livestock Report 2024), even minor tracking errors can distort profit. Integrated accounting aligns feed data with costs, giving a clear view of feed-to-gain ratios and input efficiency.

Labor and Equipment Utilization

Linking payroll and machinery data with financial records helps measure cost per hour of labor or equipment usage. Farms can identify underused assets and adjust workloads for higher efficiency.

Yield and ROI Analytics

When crop yields and herd outputs flow directly into financial reports, farms gain immediate insight into ROI per activity. It becomes easier to see which production areas generate the best returns and which need optimization.

Cash Flow and Working Capital

Integration also improves liquidity management. Expense forecasts, receivables, and sales projections are tied together, helping farmers plan ahead for input purchases or debt cycles.

According to a 2024 report by AgriData Research, farms using integrated systems improved cost visibility by 32 percent and reduced budgeting errors by nearly 20 percent. That transparency allows decision-makers to act on facts rather than assumptions.

The Future of Farm Finance: How AI and IoT Are Redefining Decision-Making

Agriculture is shifting from record-keeping to real-time intelligence. As sensors, connected equipment, and financial platforms start to share data seamlessly, farmers no longer need to rely on backward-looking reports to make decisions. Instead, they can forecast outcomes before they happen.

Artificial Intelligence and Predictive Finance

AI-driven analytics use historical and live data to predict the financial impact of operational choices. For example, an algorithm can analyze five years of feed and weather data to estimate how much a shift in feed mix will affect milk yield or beef weight.

According to the McKinsey Future of Agriculture Report 2024, predictive financial tools could help farms improve yield forecasting accuracy by up to 35 percent and reduce waste from unplanned costs by nearly 20 percent.

Internet of Things (IoT) for Continuous Monitoring

IoT sensors track field conditions, water levels, and livestock health in real time. When this data connects directly to accounting systems, it creates a live picture of cost and output efficiency. A sudden change in soil moisture, for instance, can automatically adjust irrigation budgets and forecast its impact on cash flow.

The FAO Digital Agriculture Outlook 2024 estimates that IoT adoption in mid-sized farms can increase operational efficiency by 25–30 percent within two seasons.

Folio3 AgTech’s Role in the Next Wave

Folio3 AgTech is already embedding AI and IoT capabilities into its ERP framework. The platform allows farms to use predictive dashboards that flag potential overspending, identify underperforming herds, and model different yield scenarios. For CFOs and farm managers, that means fewer surprises and more confidence in long-term planning.

Conclusion: One Connected System for a Smarter, More Profitable Farm

The future of agriculture belongs to operations that connect everything — from what happens in the field and barn to what shows up in the books. When crop, livestock, and accounting systems share the same data, managers stop working in silos and start running the business with full visibility. Prices of assets become more predictable, decisions get faster, and profitability stops being a guess.

Integrated farm accounting isn’t about adding another layer of software; it’s about removing friction. It replaces scattered spreadsheets and delayed reporting with a single version of truth that reflects how the entire farm performs in real time. Whether it’s tracking input efficiency, managing cash flow, or forecasting margins, integrated data lets farms act before small problems grow into major losses.

- Why Integration Matters: The Backbone of Modern Farm Profitability

- Connecting Farm Accounting with Crop Planning Systems

- Integrating Accounting with Livestock Management Systems

- From Field to Finance: Building a Unified Farm ERP Ecosystem

- Turning Data into Decisions: Key Metrics Farmers Can Track Through Integration

- The Future of Farm Finance: How AI and IoT Are Redefining Decision-Making

- Internet of Things (IoT) for Continuous Monitoring

- Conclusion: One Connected System for a Smarter, More Profitable Farm