A lot of times, individuals seek out a wealth manager when their financial situation becomes too complex to manage on their own.

KEY TAKEAWAYS

- Learn who you use PWM

- Discover what service it offers

- Understand how it is beneficial for HNWIs and UHNWIs

As of December 2024, North America had 8.4 million high-net-worth individuals (HNWIs). This means that more than eight million people in North America own a minimum of a million dollars in assets. When it comes to these HNWIs, mass-market financial services are not sufficient.

Private wealth management combines financial planning and investment management to help individual investors, particularly high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs), manage their wealth.

This service encompasses several interconnected processes, including personalized financial planning, specialized investment and financial advice, portfolio management, and advice on weather management, tax planning, and estate planning matters.

PWM also offers tailored solutions for the different needs of high-net-worth individuals and ultra high-net-worth individuals. Read this article to learn more about PWM and its key services in detail.

Who Uses PWM?

Private wealth management is usually offered to:

- High-net-worth individuals: People who have more than 1 million in investable assets (excluding their primary residence) need smart financial planning. PWM helps these individuals diversify their wealth across asset classes, structure their investments tax-efficiently, and prepare for retirement while focusing on wealth preservation.

- Ultra-high-net-worth individuals (UHNWIs): Individuals with a net worth of at least $30 million have even more complex needs. They need PWM to cater to their cross-border taxation, private business ownership, and multigenerational wealth transfer needs.

- Family offices: Single-family offices (SFOs) and multi-family offices (MFOs) are offices created to manage the wealth of one or more families. They centralize the family’s legal affairs, finances, and investments. These entities use PWM to coordinate accounting and financial matters across generations, custom investment strategies with a long-term horizon, and manage risk.

What Services Does PWM Offer?

PWM is holistic and addresses both the qualitative and quantitative aspects of wealth. Here are four of its key pillars:

1. Personalized Financial Planning

PWM advisors provide you with a roadmap that aligns with your life goals. These services advise you as you go through life’s transitional phases, such as career changes, marriage, or childbirth.

Advisors will evaluate your income, expenses, and timelines to ensure you stay on track regardless of market fluctuations and personal life events. As a result, you can turn your aspirations into actionable financial strategies.

Additionally, they help with cash flow planning and liquidity management to cater to the complex financial needs of HNWIs. The advisors introduce buffers to help you prepare for unexpected financial shocks. They model ‘’what-if’’ scenarios and examine how each affects your cash flow and asset values.

This information can then be used to introduce buffers like emergency reserves or insurance, ensuring your wealth plan remains resilient under pressure.

2. Investment Management

Each client and individual has different plans and goals. This may include fast growth, stable income, or capital preservation. These goals require tailored solutions, and that is what PWM offers.

Advisors assess your risk tolerance through behavior profiling and life-stage analysis, developing investment strategies that adapt to personal timelines. Consequently, you can meet your performance targets without exposure to unnecessary risk.

PWM offers two things regarding high returns: diversification and access to exclusive investment opportunities. Firstly, advisors help clients navigate complex investments. Alternative assets such as private equity, commercial real estate, and hedge funds are included here, yielding higher returns.

Similarly, clients can access institution-grade opportunities like pre-IPO shares and venture capital. While these investments have higher risk, they offer far superior returns so that you can grow your wealth in ways not open to the general public.

DID YOU KNOW

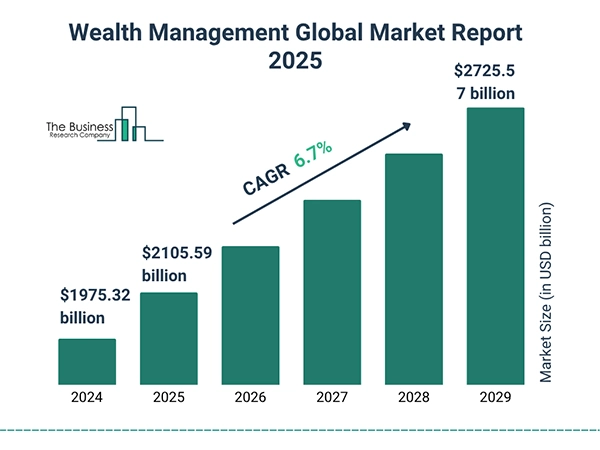

The wealth management market size has grown strongly in recent years. It goes from 1975.32$ billion in 2024 to 2105.59$ billion in 2025 at a compound annual growth rate (CAGR) of 6.6%.

3. Tax Optimization

Tax-efficient investing requires proper asset location. Wealth managers align your investment choices with the optimal account types here. For instance, high-tax assets like bonds are best kept in tax-deferred accounts, while equities with capital appreciation do better in taxable accounts so that you can yield better after-tax returns.

This can help you preserve more of your wealth by every passing year through minimizing the taxable income while maximizing compounding. Alternatively, PWM also allows you to harvest tax losses. Take capital gains taxes as an example; these can erode significantly if unmanaged.

Here, advisors monitor portfolios and sell underperforming assets to cancel out taxes on the profitable ones. This way, they can reduce your overall tax liability and enhance your assets’ long-term performance.

PWM also comes in handy during income deferral and restructuring. Simple income restructuring strategies such as using a holding company to reinvest profits without immediate taxation, can be effective for business owners, real estate investors, and those with fluctuating income. Wealth managers help plan and execute these to ensure tax efficiency without compromising control.

4. Estate and Legacy Planning

Ensuring their wealth passes on smoothly is one of the main priorities of an HNWI. Accountants work closely with legal advisors to use tools like wills and trusts to help distribute assets efficiently. They use strategies such as gifting, charitable donations, and business succession plans to preserve wealth while avoiding family conflict.

Now, PMW advisors also manage the tax filings, valuation, and compliance, which helps turn your financial success into a massive impact that lasts for generations.

Endnote

Private wealth management is a great way to handle your financial situation and meet your financial goals. It simply means working with an expert who is skilled in this field and can give you personal advice on different money-related matters.

Now this matter includes investment management, tax planning, and even retirement planning. It does not matter if you are just starting to build your wealth or you already have it; PWM can help you make smarter decisions and protect your future.