Employers calculate the salaries of the employee in fiat and will send that amount in the form of cryptocurrency. They can send it through payroll or directly.

KEY TAKEAWAYS

- Always make the payment in stablecoins that ensure proper security.

- Use a Crypto payroll app or a self-custodial wallet.

- Train employees about the new system for better compliance.

- Make sure to maintain accurate records of everything.

Did you know that the current cryptocurrency price has reached 3.92 trillion USD? As cryptocurrency continues to gain traction across the globe, companies are increasingly exploring methods to weave it into their everyday operations.

One significant domain experiencing a remarkable shift is payroll, where businesses are now providing employees the choice to receive their salaries in digital currencies. This innovative approach not only enhances flexibility but also accelerates payment processes.

However, the integration of crypto into payroll systems presents distinct challenges that must be navigated. To effectively address these hurdles, it is essential to explore the best practices that can guide organizations in this evolving landscape.

If you are also a part of a modern organization, continue reading this article to learn everything about it.

Make Payments in Stablecoins

Businesses should always pay their employees in stablecoins to ensure fair compensation. Unlike volatile cryptocurrencies, these coins are generally pegged to assets such as the United States dollar. This effectively makes sure that their value remains predictable. Stability mitigates the risks for employees and employers, makes accounting simpler, and streamlines the payroll process.

Ensure Proper Security

When it comes to cryptocurrencies, there are typically many threats and risks of fraud. Implement numerous layers of security to protect yourself and your employees from these threats when integrating these digital currencies into your payroll. Put the following security features into practice:

- Multi-factor authentication

- Encryption

- Private key management

- Role-based access control

Use a Crypto Payroll App

Based on manual data entry and spreadsheets, it can easily lead to inaccuracies with crypto payments. Thanks to the crypto payroll app, you can automate and secure your payment process. These apps make tax reporting, calculations, and conversions easier. This indicates that businesses can enjoy a smoother crypto integration and financial management.

Use Self-Custodial Wallets for Crypto Payroll

You can track and report payments more effectively by using a dedicated self-custodial wallet to handle blockchain salaries. This also allows you to take better account of your security and privacy.

Unlike custodial solutions, these wallets remove third-party vulnerabilities and improve security. Employers offer more transparency and trust, while employees enjoy better autonomy over their money. Overall, they present a more reliable approach to managing payroll.

NOTEWORTHY FACT

About 30–36% of workers are open to getting paid in cryptocurrency, and 60% of freelance payments are done using it.

Educate Your Employees Beforehand

You must help your team understand the basics of getting paid in these digital currencies to effectively handle crypto in your payroll system. Many employees may be unfamiliar with volatility risks, wallets, and taxes.

Proper training enables them to avoid confusion, make informed decisions, and build confidence. For illustration, you can get them to learn how to buy Dogecoin on Kraken or sell coins on other exchanges for the best outcomes.

Stay Compliant with Local Regulations

Always keep up with regulatory implications around crypto payments when using them in payroll systems, because digital asset laws vary across different locations. For this reason, employers must maintain compliance requirements, stay updated, and work with legal experts to ensure that employees receive their proper compensation.

Maintain Accurate Records

In case your business leverages a crypto payroll system, you must keep accurate records for audits and tax reporting. Detailed logs of tax withholdings, payments, and conversions help businesses minimize risks and meet legal requirements. With accurate documentation, you’ll also be able to demonstrate clear proof of transactions and improve financial accountability.

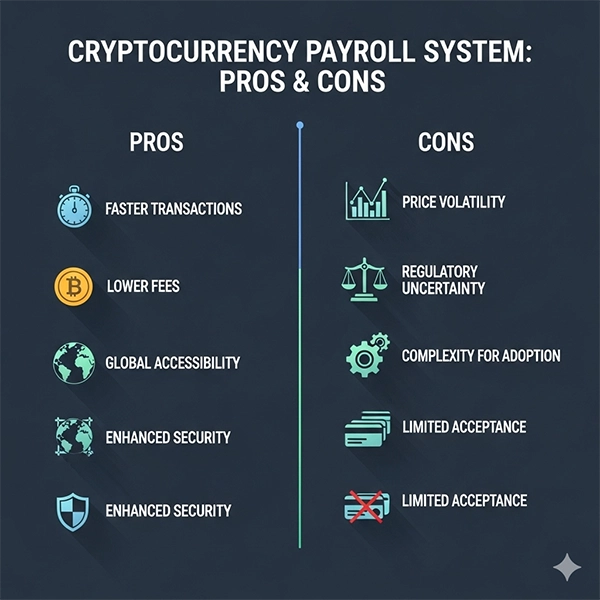

Apart from the features, check out the prominent pros and cons of the cryptocurrency payroll system with the help of the infographic below.

Endnote

Implementing stablecoins, showing robust security measures, and adopting an independent self-custodial wallet can significantly enhance operational efficiency.

In fact, it is essential to invest time in educating employees about these tools, ensuring adherence to compliance regulations. Along with this, meticulously maintaining accurate records can foster a transparent and trustworthy payroll process.