It’s a key metric lenders use to determine how much of your monthly income goes toward paying off debts. The lower the ratio, the better your chances of approval.

In the U.S., a significant majority of homes are purchased with a mortgage. According to recent data, over 80% of homebuyers in the country rely on a mortgage to finance their purchase, a statistic that underscores the critical role of successful loan approval in the real estate market.

Securing a mortgage, however, is not a simple transaction; it’s a detailed process where lenders scrutinize every aspect of your financial profile. They evaluate your credit history, income stability, and debt-to-income ratio to determine your reliability as a borrower.

By proactively preparing your finances and understanding the lender’s perspective, you can significantly improve your chances of getting approved, securing favorable terms, and navigating the home-buying journey with confidence.

If you’re planning to apply soon, here’s how to make sure your mortgage application stands out.

KEY TAKEAWAYS

- Lenders evaluate your credit history, income stability, and debt-to-income ratio to ensure you can manage the loan.

- Before applying, check your credit report for errors and keep credit card balances low to boost your score.

- Gather all necessary paperwork—bank statements, tax returns, pay stubs—in advance to avoid delays.

- Pay down existing debts to improve your debt-to-income ratio, a key factor in mortgage approval.

- Don’t change jobs, take on new debt, or make large purchases between application and closing.

- Compare different lenders, not just for interest rates, but also for fees, service, and flexibility.

Understand How Lenders Size You Up

Lenders don’t leave much to chance. They look for signs that you can handle the loan amount without trouble. They want to see a stable monthly income, manageable debt, and a credit history that shows responsibility. You don’t need a perfect record, but the numbers need to make sense.

Your job history also plays a role. If you’ve been with the same employer for a while, that’s a plus. But if you’ve changed jobs recently or moved into a new industry, be ready to explain the shift. Employment verification is part of the process. Show that, even if your income fluctuates from month to month, it remains steady over time.

If you’re looking for a stronger position before making an offer, some lenders now offer full underwriting at the start of the application process. This goes beyond standard pre-approval. With something such as an Upfront Approval Guarantee Page, you’re receiving a fully underwritten loan commitment shortly before you even start negotiating. It shows sellers that you’re not only serious but already vetted, which can give you a clear edge in a competitive real estate market.

Strengthen Your Credit Without Guessing

One of the first items a lender looks at is your credit score. A higher score can result in more favorable loan terms and faster approval. If you’re not sure where yours stands, check your credit report before applying.

Go through it carefully. Mistakes happen more often than people think. You might discover an old account that should be closed, or a payment identified as late due to an error. By disputing these, you can raise your score with little work.

Once that’s sorted, pay attention to how you use credit. Keep your card balances low and avoid opening or closing accounts in the months leading up to your loan application. These shifts may seem small, but they can affect your score at the wrong time.

Prep Your Documents Early

Nothing slows down an approval procedure more than missing paperwork. Bank statements, pay stubs, tax returns, and other documents will be requested by ders. You are self-employed, they might request extra records. Having these planned out from the beginning saves time and avoids back-and-forth in the approval process.

Commence by verifying that your records of income and contributions match. In the event there’s a large difference, have an explanation ready. Lenders want to know the sizes that line up. They are not looking for perfection, but they do prefer things to be clear. Clear records ensure that your mortgage lender process things without holdups.

Ensure that substantial deposits are recorded. If a family member has given you money toward your home purchase, you’ll oblige with a signed gift letter. There should be a straightforward explanation for anything that could cause confusion. This is particularly crucial for first-time homebuyers because lenders might require additional information about your savings.

Keep Your Debt Under Control

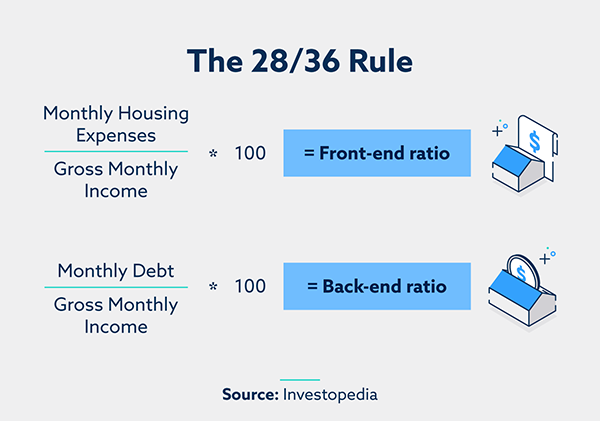

Your debt-to-income ratio is one of the most prominent numbers lenders use. It depicts how much of your income goes toward paying off debt each month. The reduced ratio, the better your chances become.

If your balances are high, start paying them down before applying. You don’t need to be debt-free, but lower monthly obligations can make a difference. Even paying off a small loan can improve your position. Solid finance management in the months leading up to your application can give you a noticeable edge.

Also, avoid taking on new debt. Don’t finance a car, open a new credit card, or agree to any new monthly payments before your loan closes. These may seem harmless, but they can shift your numbers and throw off your loan estimate or even affect final closing costs.

USEFUL FACT

A common guideline lenders use is the 28/36 rule, suggesting the monthly housing payment should not exceed 28% of your gross monthly income, and your total debt payments should not exceed 36%.

Compare Lenders. Don’t Settle.

Not every lender is the same. Some are more flexible. Others have better options for self-employed borrowers, first-time homebuyers, or those with unusual financial profiles. Shop around to see what works best for your financial situation.

Compare more than just mortgage rate offers. Look at fees, service, timelines, and how they handle your specific case. Ask direct questions. Some lenders may be more familiar with your type of home-buying process and can process it more smoothly.

When several mortgage inquiries are made in a short period of time, credit check systems frequently combine them into a single inquiry. As long as you don’t exceed the allotted time, you can obtain more than one quote without lowering your score.

Think Like the Person Reviewing Your File

Underwriters are there to double-check everything. They look for gaps, errors, or anything that doesn’t add up. If your file is clean and consistent, it moves faster and with fewer questions.

Make sure your income, tax returns, and bank activity all match. Explain anything that seems out of the ordinary before someone asks. A short, honest note can avoid unnecessary delays during the approval process.

They don’t need every detail of your life, but they do need a clear picture of your financial situation. If you give them that, your file is easier to approve. That’s the goal.

Don’t Shake Things Up Right Before Closing

You’re not done once the application is in. Many lenders check your credit, job status, and bank accounts again before closing. Any big changes could put the mortgage approval at risk.

Hold off on making big purchases, taking on new debt, or changing jobs until after closing. Even something that seems reasonable, such as buying furniture, can raise your debt and shift your numbers.

Try to continue your personal finances as stable as possible during this time. Once the loan is final, you’ll have more flexibility. But until then, any surprise can cause issues with your home mortgage.

Final Words

Mortgage recognition isn’t about luck. It comes down to timing, preparation, and making smart decisions at the right moments. Lenders want to see that you’re dependable, consistent, and ready for the responsibility of a home loan. Each step matters.

The more you more control now, the fewer problems you’ll run into later. Stay focused, keep it steady, and move forward with confidence through every stage of the home-buying process.