Conforming loans have limits set by Fannie Mae and Freddie Mac, while jumbo loans exceed these limits with no fixed cap.

Financing a home is a great challenge in itself. You will find different people suggesting different options, and all those recommendations lead to nothing but confusion and chaos. According to a survey by SoFi, 38% of prospective buyers reported being confused by the mortgage options.

Well, if you are also one of them, then this post is for you. In this post, we will discuss the key differences between two of the most discussed types of mortgage loans, jumbo loans and conforming loans. Understanding the five key differences between the two, loan limits, qualification criteria, interest rates and pricing, down payment, availability, and flexibility, will help you make a smarter decision. One choice suits high-value properties, the other is an excellent choice for standard home prices.

Knowing the facts will guide you and help prevent unexpected costs. So, let’s get right into it!

KEY TAKEAWAYS

- Conforming loans adhere to annually set limits for e.g., $806,500 in 2025 for most areas, while jumbo loans finance amounts above these limits.

- Jumbo loans demand higher credit scores, lower debt-to-income ratios, and greater cash reserves due to increased lender risk.

- Conforming loans often have lower rates due to government backing; jumbo loans may have higher rates or fees, requiring borrowers to compare offers closely.

- Jumbo loans typically require a minimum 20% down payment and rarely involve PMI, whereas conforming loans allow lower down payments but may require PMI.

- Conforming mortgages are widely offered, while jumbo loans are less common as lenders often retain them or sell to private investors, limiting program flexibility

1. Loan limits

Conforming loans follow limits set by Fannie Mae and Freddie Mac. These caps change yearly. In 2025, the standard limit is $766,550 in most counties. In high-cost areas, it rises to $1,149,825. Loans above these numbers require jumbo mortgages. Jumbo loans carry no fixed cap. They vary by lender and market. Conforming limits are updated annually to reflect housing market trends. If you are still wondering ‘What are jumbo loans?’ check out this guide to learn more.

2. Qualification criteria

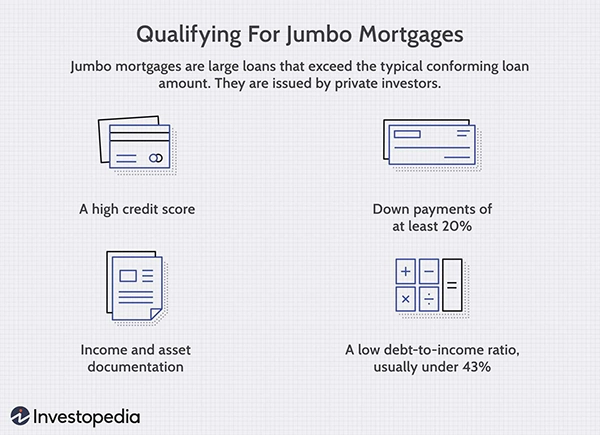

Qualifications vary significantly. Conforming loans require lower credit scores and debt ratios. Lenders often set a 620 minimum score. Debt-to-income ratios usually must be under 43%. Jumbo loans impose stricter standards. Borrowers might need scores above 700. Jumbo loans also face tighter ratios of around 36%. Lenders want proof of stable income and assets, and they may request larger cash reserves. These factors shape your monthly payments and total cost.

3. Interest rates and pricing

Conforming loans often carry lower rates. This is due to government backing and stable demand. Lenders view these loans as safer. Jumbo loans sit outside these agencies. They can come with higher rates or pricing adjustments. Fees and points may be higher, too.

In addition, some lenders add percentage-based fees. Market trends also sway rates for jumbo. Borrowers should gather quotes from multiple lenders. Compare both interest and closing costs. Sticky rates can lock you in. Be sure to ask about rate lock periods and expiration.

INTERESTING FACT

Unlike conforming mortgages, jumbo loans are not eligible for purchase or guarantee by government-sponsored enterprises like Fannie Mae and Freddie Mac, meaning lenders typically bear more risk and impose stricter underwriting standards.

4. Down payment and PMI

Conforming loans can require as little as three percent down. PMI becomes necessary when you put down under 20%. You can remove PMI once you reach 20% equity. Jumbo loans often ask for at least 20% down, and they rarely allow PMI. This means more cash up front. It also means no ongoing insurance fees. Your upfront cost can be high, but your monthly payments stay lower. A higher down payment often secures better interest rates.

5. Availability and flexibility

Conforming mortgages are widely available. Most banks, credit unions, and brokers offer them. These programs include purchase, refinance, and streamlined options. Jumbo loans are less common. Lenders often hold them on balance sheets or sell to private investors. This can limit program options. Some lenders offer only fixed terms, and others add adjustable-rate options. Refinance paths vary as well. Check lender websites for current offerings, as terms can change with market shifts.

Endnote

Understanding the key differences helps you choose the right loan. Conforming mortgages suit buyers who need predictable costs and lower rates. Jumbo loans work for those seeking higher purchase power in expensive markets. If your desired home price stays under local conforming limits, lean that way. If you need extra budget, prepare for stricter requirements and slightly higher rates. Always compare options side-by-side and get preapproval.