Non-essential and expensive items like premium cars, deluxe watches, fine jewelry, precious gems, and private jets fall under the luxury tax.

“You have to pay more taxes on luxury items, like premium cars and jewelry.”

Yes, the government imposes a luxury tax on people with enough cash flow who can easily afford expensive goods. That’s why you should be aware of tax rates before planning your next exclusive purchase.

But how do you know which items fall under luxury tax planning?

Therefore, I break down essential information in this article to help my readers about

- Lists of luxury items

- How much is the luxury tax in the US?

- Why is this tax imposed?

So, stay till the end to learn various aspects of tax rates in the US.

What is a Luxury Tax?

A luxury tax is an additional charge on premium and expensive products, such as fine jewelry and deluxe watches. The government imposed this tax on wealthy people to generate extra revenue for public services and other initiatives.

Moreover, the tax may be charged on the portion of the purchase price or as a fixed percentage of the amount. It aims to discourage excessive spending on nonessential items and promote economic equity.

The purpose behind imposing luxury taxes is to increase government revenues without affecting the general people. It only targets the rich people who potentially can afford high-end services or products.

Categories of a Luxury Tax

Luxury tax planning falls into two categories:

- Sin Tax: It is imposed on products like alcohol and cigarettes with the motive to discourage their use. This tax is paid by everyone who purchases the products, regardless of income.

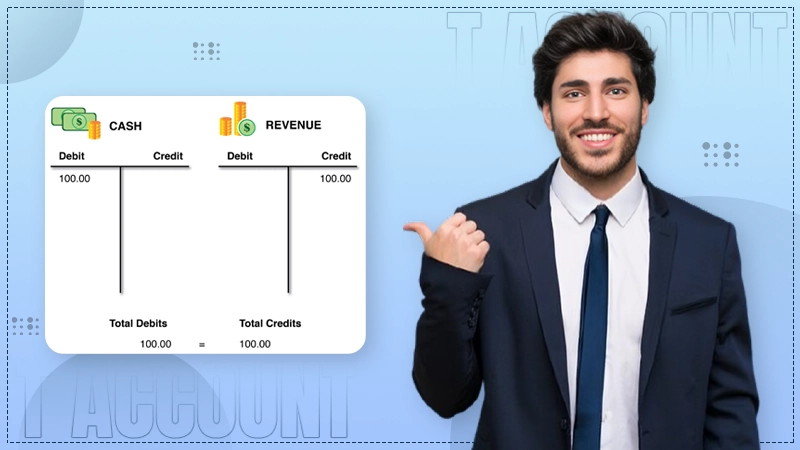

- Luxury Item Tax: Taxes on goods that can be purchased only by the wealthiest people. E.g., expensive cars, watches, and private jets. This is quite different from corporate accounting, which deals with how companies report their profits and taxes.

Types of Items Subject to Luxury Tax

A list of luxury taxes includes a wide range of expensive goods, which are known for their exclusive status. So, you have to be aware of these deluxe items to determine the tax on your next purchase.

Here are the following items that are obliged to have luxury taxes:

- Luxury Cars

High-end automobiles, including sports cars, sedans, and premium SUVs, fall under the luxury car tax category.

- Private Jets and Aircraft

Owners of private jets, aircraft, and helicopters are subject to a luxury tax because they are too expensive to purchase.

- Yachts and Boats

High-end boats and private yachts are also listed under luxury items.

- Jewelry and Watches

Expensive jewelry, including diamonds, precious gems, and 24ct gold, and deluxe watches, are purchased as a status symbol.

- Art and Collectibles

Furthermore, rare and unique arts, paintings, and collectibles are subject to additional charges.

- Fine Wines and Spirits

Alcoholic beverages, such as fine wines, aged whiskies, and premium champagnes, are only afforded by the rich. So, it is also obliged to pay taxes.

Fun Fact: The US government imposed a 10% luxury tax on expensive goods, but it was repealed in 1993.

Just like luxury purchases, managing wages payable or accounts receivable also requires financial discipline.

How Much Luxury Tax is Charged in the US?

In the United States, the federal government imposed a 10% luxury tax on high-end goods. It is especially levied on the retail sales of boats, yachts, and aircraft above a certain price verge.

On the other hand, some states like New York and Connecticut also have in-state luxury taxes. State and local jurisdictions’ tax rates can range from 2% to 10%, depending on the standard sale price.

Let’s understand with examples:

A luxury car worth $1,500,000 may be taxed at 10% federal tax. So, you have to pay $150,000 more in order to purchase your favorite car. As per the luxury car tax, you are obliged to pay a higher amount on the premium cars.

This calculation is quite similar to how companies use standard costing to evaluate variances in expected vs. actual expenses.

Why are Luxury Taxes Imposed in the US?

There are typically three main reasons behind introducing luxury taxes: to generate additional revenue, to promote social equity, and to discourage excessive usage of non-essential items.

Let’s take a look at the following reasons in great detail.

Generate Additional Revenue

The federal government imposes a luxury tax on wealthy people to generate additional revenue for public services and infrastructure facilities. By targeting expensive items such as cars, private jets, and fine jewelry, it doesn’t affect common people.

Social Equity

Another reason for collecting taxes is social equity. It reduces income inequality and the discrepancy between the poor and the rich in a country. The government collects funds from the wealthy and spends them on public welfare. This provides opportunities for common people to upgrade their lifestyles.

Discourage Excessive Usage of Non-Essential Items

Moreover, luxury taxes can also be levied on the people to discourage the excessive usage of non-essential items. For example, taxes on cigarettes and alcohol are used to minimize the consumption of such dangerous items. It promotes a healthy lifestyle and reduces the risk of cancer.

Challenges and Disputes of Luxury Taxes

Business owners don’t support luxury taxes and argue that such taxes can be economically inefficient and fail to meet their intended goals, ultimately damaging businesses.

Here are the following challenges business owners encounter due to the imposition of the luxury tax planning:

- High taxes on deluxe items increase the final cost, resulting in a decrease in sales and revenue.

- When demand decreases, it directly lowers the production level. This forces businesses to lay off workers.

- In many cases, wealthy people choose countries with low tax rates to buy expensive products.

- This way, the domestic businesses are collapsing and reducing the effectiveness of the tax law.

As a result, it ends with an administrative burden on the government to implement and enforce the luxury car tax or other taxes. The complexity of this tax creates legal disputes in tax liability and challenges, which results in decreasing the effectiveness of tax collection. These disputes can be compared with issues around accounts payable or notes payable where businesses must remain compliant.

Luxury Tax vs. Sales Tax: What’s the Difference?

Luxury and sales tax are both consumption taxes. However, they are different from each other in purpose, tax base, and tax burden.

So, if you’re always intrigued by them, look at the breakdown table for in-depth information.

| Features | Luxury Tax | Sales Tax |

| Primary Purpose | It is levied on non-essential and high-end goods to target rich people and promote social equity. | It is a consumption tax that is paid by everyone to the state or local bodies on the sale of goods and services. |

| Tax Base | Luxury items like cars, boats, yachts, jets, helicopters, jewelry, etc., are only affordable to wealthy people. | A broad concept of retail sales. It is typically a percentage of the sale price applied to the whole nation. |

| Who Pays | Rich people who can afford expensive items. | Generally paid by the overall population. |

| Tax Burden | Progressive; higher burden on high-income individuals | Regressive; low-income individuals pay more on taxable goods. |

The Bottom Line

Luxury tax only targets wealthy individuals to promote social equity and discourage the excessive use of non-essential goods. However, the complexity of this tax led the federal government to repeal it in the United States.

Therefore, it’s a wise decision to opt for tax outsourcing services to keep updated with federal laws. Businesses often rely on management accounts services or explore best outsourced accounting services to stay compliant. The experts here deliver you peace of mind and reduce your tax liability.