Yes, they are essential as they automate and streamline financial tasks like accounting, payroll, and invoicing, ensuring accuracy and compliance with regulations.

Did you know? Modern financial tools offer a wide range of benefits for businesses, from streamlining operations and improving accuracy to enhancing decision-making and reducing costs. (Thought Spot)

In today’s tech-influenced professional realm, we are moving forward towards an innovative future filled with a lot of new-gen tools aiming for automation and less complexity.

A few years back, technology was used in some fraction of sectors, but today it is everywhere, and it has impacted the financial domain the most.

There was a time when managing and assessing capital resources used to be a hectic task, but after the emergence of advanced algorithms, you can perform anything with just a few clicks.

In this blog post, we are going to talk about them more deeply and understand how they are becoming the pivotal forces for supporting and assisting the critical professional resources of the business institutions.

Let’s begin!

Key Takeaways

- Understanding the new approaches of fintech tools that are making complexities easier than ever.

- Uncovering the drastic rise of cloud accounting and how it works to enable real-time reporting.

- Analyzing capital resources from distinctive platforms to obtain sustainable growth.

- Discovering the use of AI utilities in driving the automation of financial practices.

- Unfolding the crucial role of data analytics in calibrating financial decisions.

- The end note.

Leveraging Fintech Tools for Streamlined Operations

Technology associated with finances (fintech) is changing the way businesses manage their finances. In the past, companies managed something like payroll, tax filings, expenses, invoices, etc., in a fairly manual way. Financial apps and digital platforms now allow companies to automate what used to be repetitive, manual tasks.

These solutions allow companies to keep accurate records by alleviating human error and saving both time and effort. Many fintech site provide business owners with live data on cash flow, profitability, and spending trends, which allows owners to make quicker and better decisions.

Fintech solutions are also built to integrate easily with your other business tools, like your accounting software, inventory management system, and CRM, to help all departments be connected. Some solutions even offer financial forecasting and budgeting tools or payment processing.

The Rise of Cloud Accounting and Real-Time Reporting

Cloud accounting software allows businesses to manage their finances online and eliminates traditional paper-based accounting and cumbersome desktop programs. With real-time updates, businesses know exactly where their money is going.

Using cloud accounting, with automatic bank feeds or online invoicing, is faster and allows business owners to make smarter decisions more quickly. Cloud accounting allows collaboration from any location with multiple users (like accountants or managers).

Security features keep your data safe, and through backups, there is less opportunity for any data to be lost. Real-time financial reports provide instant visibility to profit, expenses, and cash flow, allowing businesses to respond quickly to challenges or opportunities.

Accessing Capital Through Alternative Lending Platforms

Traditional bank loans can be difficult to obtain, especially for small businesses. This is part of the reason that many small businesses are exploring alternative lending platforms. As an online service, alternative lending platforms can provide faster access to capital through an easy application process and quick approval times.

Options like peer-to-peer lending, revenue-based financing, sourced funding, and crowdfunding help businesses access funding in a much quicker time frame than a bank loan. Many alternative lending platforms may even utilize customer data sources like online sales or customer reviews when reviewing applications.

Making access to funds easier for new businesses. Being able to access funds with fewer restrictions and repayment options that can fit into existing cash flows allows alternative lending to serve as a new path for growth in small businesses.

Utilizing AI and Automation in Financial Management

Artificial Intelligence merged with automation can greatly benefit your financial management. AI can analyze various spending patterns and identify suspicious activities that need your attention. It can even suggest ways in which firms can save money.

Automation is a real time saver as it will speed up the repetitive task and free up manpower that can be utilized in other things. Manual work like bill payments, payroll processing, and financial forecasting etc. will be done by it.

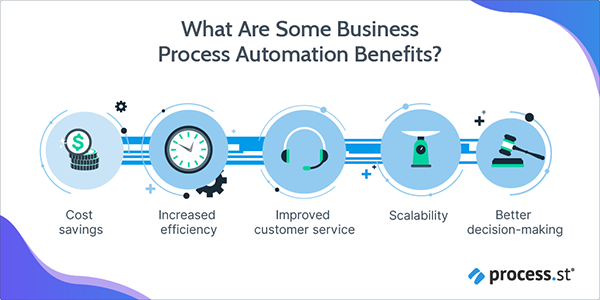

Since there won’t be any human input, fewer mistakes will be made, and more time will be given to the growth of any business. Below, you can see several benefits of process automation in business.

The Role of Data Analytics in Driving Financial Decisions

Data analytics has become quite crucial these days, as it helps make great financial decisions. By analyzing sales, expenses, and customer behavior, better decisions can be made. You can check which product is profitable and which one isn’t.

With such details in hand, you can make strategies related to budgeting, pricing, and market visibility. Things like the financial dashboard give visual summaries that are easy to understand and act on.

Final Words

Businesses can reach greater heights with modern finance solutions. Various solutions make the overall operation easy. Fintech tools are always going to be your partner, and their capabilities will create a path towards success.

Fewer errors will be made, and productivity will be boosted further. Traditional methods are not going to give great results in this digitalized era, you have to adapt accordingly and leverage these solutions to their maximum potential.