Yes, you can migrate files and data from Pandle to QuickBooks in CSV format, then import the data with the import tools in QuickBooks.

Bookkeeping is the backbone of every thriving business out there, yet it is the thing entrepreneurs dread about. The numbers, long Excel sheets, and receipts might mess up your mind and even the operations if not done correctly. So, how to avoid such a situation?

You need to use Pandle Bookkeeping software to cut the noise and get an effective and simple automated process. I’ve been testing and using the accounting software category Pandle for a few months for my business now, so here’s my insider information on what is good and what doesn’t work.

Read this Pandle software review and see if it suits your business.

Pandle Bookkeeping Software: Overview

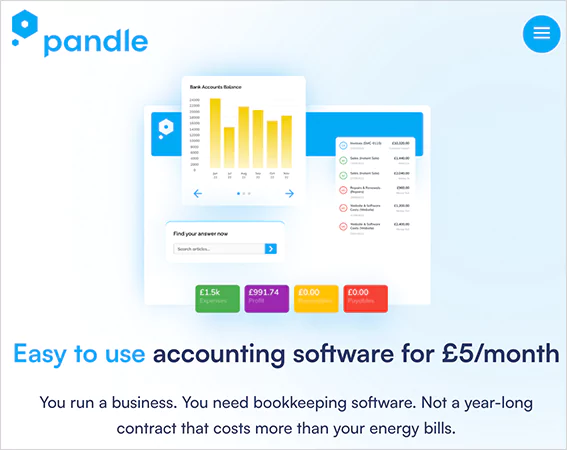

The first time I ran across Pandle, there wasn’t any loud advertising or technical jargon to prove authority. Instead, it was all about how it can make bookkeeping easy for small businesses, and truly, this is what every business owner needs.

Pandle is a small business and freelancer-friendly bookkeeping software created in the cloud, which caters to the needs of startups, small, and medium-sized businesses. It is based in the UK and is widely known for its simplicity, automation, and real-time accuracy of financial information without the daunting learning curve typical of other accounting platforms.

This accounting software freeware allows users to record transactions, issue invoices, reconcile bank accounts, track VAT, and cash flow, all in a single dashboard. The best part is, it is user-friendly and completely cloud-based, making it easier to access and share information anytime and anywhere.

To put it simply, Pandle is a cloud-based bookkeeping software that makes the process logical, reachable, and human with automation and accuracy.

Pandle Bookkeeping Software: Features

Pandle offers basic bookkeeping services and is tailored to assist in simplifying all accounting functions without subjecting the user to redundant complexity. Time-saving and human-error saving, all features are based on automation and reporting, which is most appropriate to freelancers, startups, and small businesses operating day-to-day accounts.

Automation of Banks and Transactions

Pandle is linked to bank accounts, and it will automatically import transactions in real time. Users are allowed to apply bank rules, which would classify recurring charges (e.g, marking all charges to Google Workspace as Software Subscription).

This automation saves drastically on manual entries, provides consistency in the data, and is useful in maintaining clean and accurate books over the course of a month.

Smart Invoicing

Pandle makes it easy to create and manage invoices. Full accounting can be done with custom templates, such as logos, payment terms, and automated reminders for overdue payments. It is simple to forward invoices to the clients upon their payments, the system balances them with the received transactions, and the outstanding payments and cash flow are well visible.

Expense Management

The cost-tracking software at Pandle allows uploading the receipts and connecting them to the transactions directly. Receipt capture (coming with the mobile application) enables users to capture receipts and store them immediately, eliminating the use of paperwork and ensuring proper reporting of expenses to the authority.

Real-Time Reporting

The software helps to gain immediate feedback about the business performance. You can see profit and loss reports, balance sheets, cash flow statements, and VAT summaries at a glance. The updates are real-time, and hence, the decisions are made using the latest financial information.

Supports Multiple Currencies

If your business has multiple operations within different countries, Pandle allows integrating digital currency payments in multiple currencies and automatically updates the exchange rates. It makes it convenient for business owners by reducing the manual work of converting digits.

VAT and Compliance Tools

Pandle is Making Tax Digital (MTD) compliant in the UK. Items can be added, and VAT returns can be prepared, reviewed, and submitted within the platform directly to HMRC. The system records VAT requirements automatically, and none of the deadlines and calculations are missed.

Apart from that, you can easily integrate the software with various instruments such as PayPal, Stripe, and other banking APIs.

Pandle Bookkeeping Software: Pricing

As you now know about the features and how they make accounting and bookkeeping simple, let’s talk about the pricing you need to pay.

| Plan | Subscription Fee Per Month | Who is It Best for? | Key Add-Ons |

| Pandle Free | None | Freelancers and beginners | This free bookkeeping software offers basic accounting, invoicing, and payment reminders. |

| Pandle Pro | £5 + VAT | Startups and Small Businesses | It offers bank feeds, clear reporting, automatic uploads, and cash-flow forecasting. |

| Sole Traders | Partnerships | £24.50 + VAT | For solo entrepreneurs and limited liability partnership companies | Dedicated accountant, annual tax efficiency review, reminders, personalized schedule, and unlimited support. |

| Limited Companies | £34.50 + VAT | For a big organization looking for a full-time accountant | Dedicated accountant, proactive checks before submission, year-end reports, and automated reminders. |

The best perk of using this bookkeeping application is that you get the flexibility to add on additional services as your business grows.

- Self Assessment for £10.00 per month.

- Bookkeeping for £20.00 per month.

- VAT returns for £35.00 per month.

- Payroll for £24.00 per month.

- CIS returns for £6.00 per statement/subcontractor.

Pandle Bookkeeping Software: Performance and Logic

Pandle has a simple, automated, and affordable philosophy, and here’s how it functions in everyday practice:

- Ease: There is no complex functionality that requires more than 2 clicks. All the features are accessible and organized logically.

- Automation: Pandle operates silently in the background and cuts down on repetitive manual work.

- Affordability: Pandle does not introduce paid add-ons to expand the Pro tier, but makes it small yet effective. The tools meet every criterion for simplifying bookkeeping and accounting with a super-simple dashboard.

The one aspect upon which Pandle sometimes falters is speed. When you are working with a large dataset or several accounts linked together with each other, it might take a little longer to refresh.

Pros and Cons of Pandle

Pandle is great, it’s true, but it also has its own downsides, which can be improved. Since I’ve been using the software intensively for my businesses, here’s what I actually liked and other things that can be improved:

Pros of Pandle

- User-friendly and Intuitive Interface: The dashboard displayed in the Pandle is clean and clutter-free, making bookkeeping accessible to a non-accountant. Operations such as settling of transactions, invoices, and receiving receipts are easy and take only a few minutes.

- Affordable Pricing: Cost efficiency is one of the strongest strengths of Pandle. It has a free plan with basic features and several pro plans starting at £5.00 per month. The free bookkeeping software works best for freelancers, startups, and large businesses alike.

- Cloud-Based Accessibility: The fact that it is a complete cloud-based platform allows users to manage an account from any place, whether at the office or on the go. The data and numbers get updated in real time, and it does not require any additional installations.

- Automated Bank Feeds and Categorization: Pandle automatically imports and classifies transactions, saving hours of manual entries. It makes the bank processes even smoother, with 100% accuracy and consistency in your books.

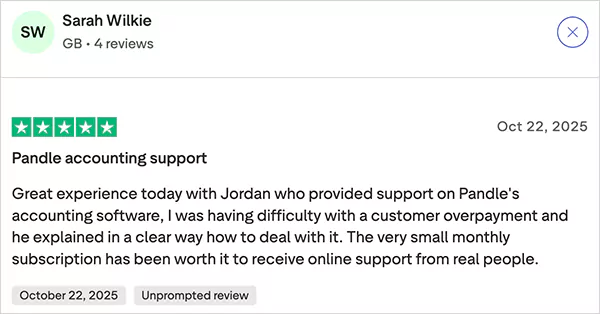

- Strong Customer Support: The support team is very responsible. I was having a hard time figuring out how to manage multiple accounts and the balance sheets, and the team helped with through and through to understand the entire process. You can either call them or reach out via live chat.

- MTD-Compliant VAT Filing: Pandle adheres to the HMRC rules and helps users to prepare and submit VAT returns directly via the platform.

Cons of Pandle

- Limited Opportunity for Integrations: The free bookkeeping software UK does not support a variety of third-party connections (such as CRMs or sophisticated e-commerce systems). This can be restrictive to businesses that require large-scale automation.

- Occasional Sync Delays: Many customers have reported poor loading speed or some delays in data syncing, especially when dealing with large transaction volumes or multiple bank accounts.

- UK-Centric Focus: Even though Pandle can be used anywhere in the world, the VAT and tax features are mainly focused on UK businesses.

Pandle Bookkeeping User Reviews

My experience with Pandle has been really fruitful so far; it has genuinely resolved my day-to-day bookkeeping worries and makes it easy to connect and share the real-time data with the team members. Another aspect I am really content with is the customer support.

Well, it has definitely caused a few issues while working on multiple projects simultaneously, but given the price point and simplicity, this one works best for me.

If you are finding a bookkeeping software online for yourself, don’t just take my word; see what other users have to say about the software as well to know what you’re getting into.

With more than 1,200 reviews, Pandle has been marked with a 4.6-star rating on Trustpilot.

Should You Try Pandle Software? – The Final Verdict

I will definitely give my stamp of approval for this bookkeeping application. Pandle provides all that a freelance professional, small business needs with bookkeeping. It has the power of simplicity and niche functionality. The ability to handle invoices, bank feeds, expenses, and VAT all in one platform at a low monthly cost is very strong.

However, the caveats matter too. The software offers limited integration options and may take time to load while working on heavy files.

In my opinion, Pandle is a pretty solid option, provided your accounting requirements are not too performance, and you do not mind using something that is easy-to-use and cost-effective. Also, there’s always an option to add on extra features as you predict quick growth.