In addition to the purchase price, hidden costs of car ownership include car insurance, ongoing car maintenance, and changing fuel prices.

KEY TAKEAWAYS

- Car ownership costs go beyond purchase price, including insurance, fuel, and maintenance.

- Comparing financing options like loans and leases helps match payments to your budget.

- Setting aside emergency funds prevents stress from unexpected car repair expenses.

- Choosing essential features over luxury add-ons keeps your car budget realistic.

According to a recent report by AAA, the average annual cost of owning and operating a new car in the U.S. is currently more than $12,000, which shows just how costly car ownership can be if not planned properly.

That’s why it’s important to create a budget that includes actual costs and expenses as well as hidden costs and expenses. A budget will not only help you avoid financial pressure but also ensure that your car remains an asset instead of a burden.

In this article, we’ll look at how to evaluate the real costs of car ownership, outline some of the more common costs, and offer some practical steps to put a budget in place that meets your financial interests.

Understanding the True Cost of Car Ownership

When planning your car budget, the first step is to recognize the total cost of ownership. This includes more than just the purchase price; it encompasses costs like insurance, maintenance, fuel, and taxes. The American Automobile Association reports that the typical driver spends about $9,600 each year on vehicle ownership, covering various expense categories. Insurance is a major part of this equation. Rates can vary significantly based on factors such as your location, driving history, and the type of car.

It is advisable to shop around and compare quotes from different providers. The team behind https://www.chrysler-factory-warranty.com/dodge-warranties-mopar-extended-warranty-cost/ says that considering extended warranties and service packages can help reduce unexpected expenses. Maintenance is equally important and shouldn’t be ignored, as regular inspections and unexpected repairs can quickly accumulate in cost.

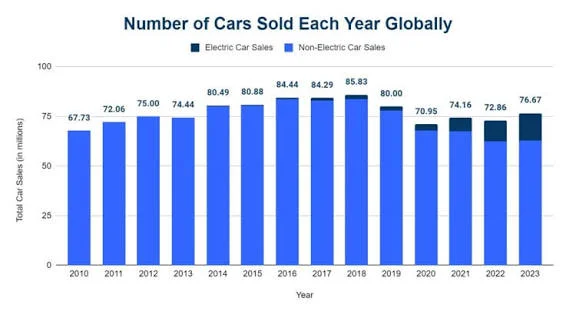

Below, you can see the comparison between how many electric and non-electric cars have been sold over the years.

Regular oil changes, tire rotations, and brake inspections fall under routine maintenance that can prevent larger costs later on. An average driver may spend about $1,200 to $1,500 a year on routine maintenance and repairs. Fuel costs fluctuate and can heavily influence your monthly budget.

Knowing your vehicle’s fuel efficiency is key to estimating costs. Hybrid or electric cars usually reduce fuel expenses compared to gas engines, freeing up money for other needs.

Financing Your Vehicle: Loans and Lease Options

Once you understand the true cost of ownership, the next step is determining how you will finance your vehicle. This could involve a loan or leasing option. Deciding between these two methods is important and should align with your budget. Taking out a loan helps you build equity in the car, but the added interest costs can accumulate significantly over time.

Monthly payments typically depend on the loan amount, interest rates, and the loan duration. Leasing a car can significantly lower monthly payments since you are essentially paying for the vehicle’s depreciation over the lease term rather than the full price. Remember that leasing usually comes with mileage restrictions and specific terms that determine when the vehicle must be returned.

It’s wise to evaluate interest rates from various lenders and read through loan terms and conditions to find options that best fit your financial situation. It’s important to understand your credit score, since it directly influences the financing rates you’ll be offered. Meanwhile, your budget should allow for these payments while keeping other expenses in check.

Setting Aside Emergency Funds for Repairs

Life rarely goes according to plan, and the same is true for your vehicle. An emergency fund specifically for car repairs can alleviate stress when unexpected expenses arise. Many experts recommend saving at least $500 to $1,000 to tackle minor repairs before they become significant issues. This fund provides a financial buffer, keeping your daily expenses intact and helping you avoid debt.

Regular saving practices can make building an emergency fund more manageable. Set aside a specific amount each month for this purpose, treating it like a mandatory expense. This can help cultivate an approach that secures your financial stability regarding your vehicle. Reviewing your car insurance policy could help you save money, especially if it includes roadside assistance for emergencies. Make subtracting potential repair costs from your budget a habit; it may save you significant sums later.

Evaluating Your Desired Features and Making Trade-offs

When buying or leasing a car, it’s easy to get caught up in features and add-ons. Understanding which features are essential versus just desirable can help you stick to your budget. Begin by determining your must-haves, such as safety features or fuel efficiency, and separating those from luxury options that can escalate costs.

An example could be opting for a vehicle with fewer technological features if that won’t serve your day-to-day needs. Systems that offer advanced navigation or entertainment may seem appealing, but if they drive up the cost, it may be better to skip them. Used cars may include appealing features, but carefully evaluating their worth in relation to your budget is crucial.

Think about your lifestyle when making trade-offs. Larger vehicles such as SUVs and trucks could offer more space but typically come with higher insurance and gas costs. Compact cars may suit urban environments better and be easier on your wallet. Creating multiple budget scenarios with different car options can help you identify the most cost-effective choice.

Revisiting Your Budget Regularly

Creating a budget is not a one-time event but an ongoing process. Situations can change, necessitating revisions to your car budget. Market changes can affect the costs of insurance and fuel, whereas personal circumstances may alter your income or expenses dramatically. Schedule regular reviews of your car budget, ideally every six months or at minimum once a year.

Assess whether your needs have changed, whether you are spending within your limits, and if unexpected expenses have necessitated adjustments. If it proves too tight or finds surplus funds, either case should prompt a rethink. You can revise your budget using spreadsheets, budgeting apps, or even traditional pen and paper.

Simple calculations can show you where changes are necessary and highlight patterns or themes in your spending behavior. Customizing forecasts or setting new targets can feel empowering and assured in your financial path. Being flexible in your approach will help you manage a budget that meets your evolving needs without causing financial stress.

Budgeting for a car extends beyond the purchase price. Car expenses include a range of costs such as insurance, maintenance, and fuel. Understanding these elements facilitates more informed financial decisions and enhances road safety as well. Whether it’s financing or saving for emergencies, creating a realistic car budget that aligns with your finances and personal priorities is essential.