When the customer takes credit, the company has to generate an invoice, file the sale in the accounting sheet, track payment, and make collections.

Businesses follow the exact same beat – you provide the service or sell the product and receive payments in return. But what happens in the cases when the amount is pending? How do you track payments from customers? Well, that’s where accounts receivable steps into the light of business management.

So, what is accounts receivable? It’s the amount that the customer has to pay for the product they have received, which was promised to be paid for later. In simple sales terms, it is the income earned that’s yet to be received.

Let’s dive deeper into what is account receivable, why it matter, and how it acts as a financial backbone for the company’s operations.

What is Accounts Receivable Meaning and Definition

Accounts receivable might sound like complex accounting jargon, but in terms of accounts receivable definition, it means the money a customer owes to the business for the goods or services.

The simplest example is the buy now pay later format or EMI format, where a person buys the product on credit and agrees to pay later on pre-decided terms. The company then records these amounts on the credit side of the company’s balance sheet as current assets. The due payment is expected to be received by the company within 30, 60, 90 days, or even a year, based on the agreement. In many cases, the interests are accrued for the time period till the final payment is made.

Tracking accounts receivable is crucial to maintain the ongoing and future cash flow of the business.

So, now that you know what is accounts receivable, let’s go deeper and understand its different facets.

Is Accounts Receivable an Asset?

Yes, accounts receivable are classified as a current asset in financial statements.

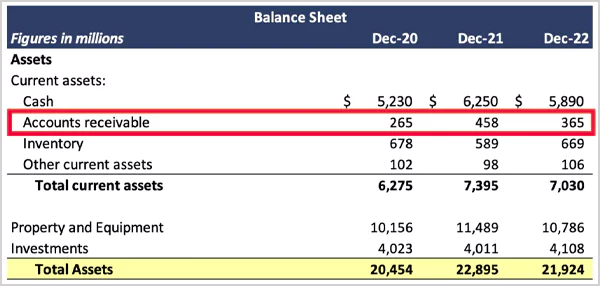

When the A/R is high, it shows that the sales are high and the company has strong financial health. In the balance sheet, it is written under the list of current assets along with cash, inventory, and short-term investments, as accounts receivable are assets.

As A/R meaning in technical terms, it is the money a customer is legally bound to pay to the company; thus, the business holds the right and power to claim the payment. It is also essential on the lender’s part to keep A/R tabs in check. Neglecting will lead to delayed payments and bad debts, which can automatically damage the operational assets and cash inflow.

So, to answer: is accounts receivable an asset? Yes, it is an asset held by the company in the form of future cash based on sales. Plus, it gives a clear view of the company’s liquidity and overall financial health.

How Does Accounts Receivables Work?

Accounts receivable appear to be a simple exchange, but there’s a whole lot of process that goes behind to make it work. It involves multiple accounting aspects, careful tracking of documents, and various departments of the company.

To show a clear picture of the accounts receivable workflow, we have written a step-by-step breakdown of the process here:

Business Makes the Sales: The consumers buy the product, but make the deal to pay at a future date rather than paying at the point of sale. Their name and banking details are verified.

Issuing Invoice: Once the customer is eligible to pay later based on their credit terms, the company records the customer’s details and issues an invoice. This paper or electronic invoice generally tells about the amount owed, due date, and payment terms.

Recording Accounts Receivable: The due amount of every sale is then recorded in the balance sheet under current assets as accounts receivable. This entire column highlights the expected income of the business.

Payment is Cleared: Once the customer pays the due amount, the accounting sheets are immediately updated. The A/R section is cleared, and the amount is then moved to the company’s cash or bank statement.

Payment Tracking and Follow-Up: In case the customer does not pay the bill on time, the business needs to follow up and charge late fees. Moreover, the A/R section has to be cleared immediately after the payment is received to avoid confusion.

So in short, you can say that accounts receivable is the time frame between delivering value and receiving payment. Though pay-later schemes offer flexibility to the customers, the company’s accounting requires close attention.

Accounts Receivable vs Accounts Payable

The success of a business can be determined based on how efficiently it can manage its cash flow. Knowing where the money comes from is not enough; it is important to have a clear view of the outflow too, to avoid bad debts and interest.

Therefore, having a grasp on accounts payable is as important. Here’s the thing: people often get confused between these terms and many times find it hard to differentiate between the two. Thus, we have decoded the meaning and differences of both counterparts below:

| Features | Accounts Receivable | Accounts Payable |

| Definition | The money the customer owes to the business. | The money the business owes to vendors or third parties. |

| Accounting Representation | Recorded as current assets on the balance sheets. | Recorded as a current liability on the balance sheet. |

| Business functionality | Sales made to customers on credit. | Purchases from vendors on credit. |

| Cash Flow | Inflow | Outflow |

| Focus | Timely collection of the funds. | Timely payments to avoid interest or late charges. |

So, why is learning accounts receivable vs accounts payable important?

It helps to build a sound relationship with the vendors and suppliers and shows insights of net cash position and working capital. This is the first skill every founder, accountant, or manager must learn to stay on their game with the numbers.

Why Accounts Receivable Matters for Businesses?

Businesses having a great number of sales still struggle to keep up with the financials. Why? Because the money owed for a product or a service still hasn’t hit the bank account. That’s how accounts receivable become crucial to track the sales made and receive the money.

Here are more reasons why it matters:

Managing Cash Flow: Any business can operate smoothly, launch a new product or service, and expand only when they have proper inflow and outflow of cash. Accounts receivable help to check the pending amount and claim it timely manner.

High Revenue: The net revenue of the company depends on the amount it gets per sale, and accounts receivables record the income in real-time and recover the funds.

Customer Relationship: Offering credit to the customers attracts more sales; however, tracking the payment timely requires effort. Accounts receivable will help you to inform your customers about the dues on time and strategize tactfully about the late fees.

Financial Planning and Performance Metrics: Accounts receivable show a clear picture of how your business is collecting payments. It gives you tools like Days Sales Outstanding (DSO) and accounts receivable turnover ratio that support you in making informed decisions, chalking out financials, and strategizing credit policies.

Effectively managing the accounts receivable formula will not only bring money but also build a strong financial pillar of the company.

Common Terms Related to Accounts Receivable

Accounts receivable builds a solid financial foundation for the business and has its own set of accounting terms. You must learn the common terminologies to have a grasp of the concept at its core.

Here are a few essential terms you’ll find on documents:

- A/R’s or A/R: a/r meaning is the short form for “accounts receivable”.

- Invoice: Paperwork issued to seek payment.

- Net 30 / Net 60: Days allotted for payment completion.

- Credit Terms: Negotiated conditions between the purchaser and the vendor concerning the payment schedule.

- Bad Debt: Non-recoverable accounts receivable.

- Aging Schedule: A report detailing the receivables based on the duration they have been overdue.

- Accounts Receivable Formula: Used to calculate the days for collecting payments.

Accounts Receivable Formula:

Turnover = Net Credit Sales/Average Accounts Receivable

Key Takeaways and Wrap-Up!

By now, you know that accounts receivable is not just another accounting term but an important component that reflects the overall financial health of the company. We have learned why it is critical and how it works in this blog. So let’s just quickly recap:

What is accounts receivable? It is the money customers owe to the business for the products or services they have received on credit.

Is accounts receivable an asset? Yes, it supports managing the liquidity, trust, and controlling the income pipeline.

Hopefully, the information above will help you reinforce your understanding of A/R and plan out a healthy cash flow for your business!