The international currency market or forex has been going through some major changes because of the new advancements in technology. This change is going to be revolutionary, changing one of the world’s most important financial fields forever.

New opportunities are getting opened not only for banks or investors but also for normal people. So, what have you been up to? Are you going to take this opportunity or let it slide? Also, learn about Crypto FintechZoom by reading this article. To stay informed about these changes, consider subscribing to a crypto newsletter. These newsletters offer insights into market trends, technological advancements, and expert opinions, helping you navigate the evolving landscape.

But how is digitized currency changing the world? This is the question you must be asking yourself and we are here to answer it for you. We will tell you how cryptocurrency has started to take over the market and is becoming significantly trustable.

Trends in International Currency Exchange

“Blockchain simplifies currency exchange, making it as easy as sending an email,” says Iryna Tsymbaliuk, a financial analyst on all about international exchanges at RATES.fm. Technology in the finance world not only transforms how money is managed but also significantly impacts the economy’s structure

It shifts from local markets to global markets and from selective access to democratization. Let’s delve into two important fintech terms: blockchain and cryptocurrency. These concepts epitomize the technological revolution within the financial sector.

Decentralization & Trust

Imagine a world where currency transactions occur without brokers – no banks, no middlemen, and this will result in no fees. This summarizes the essence of decentralized blockchain exchanges.

These systems, represented by cryptocurrencies like Bitcoin and Ethereum, bypass the need for intermediary bank services. To put it in perspective, transferring money between banks usually costs between $15 to $25, while international transfers can reach between $30 to $50, plus additional charges.

In contrast, cryptocurrency transactions only pay minimum fees of 1% or no fees at all. No wonder why people have been doing more transactions in the form of digital currency. Because it is lighter on their pockets

- Technical side: Every cryptocurrency transaction is recorded in a fixed digital entry that can be assessed by any participant. This approach provides transparency, reduces the risk of fraud, and builds trust between parties. Every cryptocurrency transaction is recorded in a fixed digital entry that can be assessed by any participant. With tools like the Ethereum blockchain API, developers can access and verify transaction data seamlessly. This approach provides transparency, reduces the risk of fraud, and builds trust between parties.

However, some people don’t approve of this method. The most well-reasoned among them is that cryptocurrency is too volatile and unpredictable to inspire trust. However, this assertion is not entirely accurate.

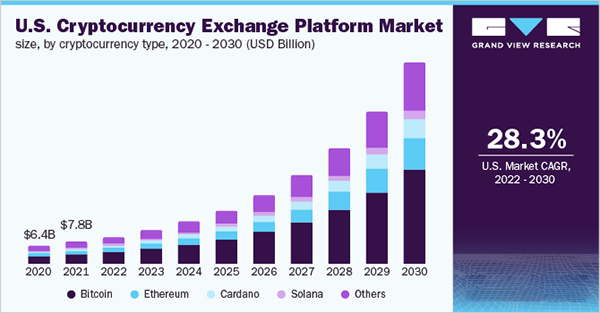

- Consider this: Global cryptocurrency trading volume is projected to exceed $108 trillion by the end of 2024 – a staggering 90% increase from the figures in 2022. Europe leads the way in cryptocurrency transactions, with Binance as the dominant exchange, according to Coinedition.

To address volatility, expanding portfolios and applying a touch of common sense can mitigate risks, advice that holds for both cryptocurrencies and traditional currencies.

Artificial Intelligence and Automation

As digital technology penetrates the most important sector of the economy – finance – manual transaction management has been replaced by artificial intelligence, speeding up processes and simplifying cross-reporting of foreign exchange.

Platforms driven by AI and automation are enabling not just banks but individuals to access fast, low-cost, online currency conversion and trading. For those interested in taking advantage of digital forex markets with greater accessibility and professional-grade tools, the Axi trading platform is a notable example—offering secure access to global CFDs and forex trading from nearly any connected device.

- How it works: AI algorithms analyze market data in real-time and offer the best rates and instant transactions. This approach removes the human factor and is way faster.

Eliminating random errors, reducing transaction costs, and opening up the service to 67% of the world’s population that uses the internet. A fintech analyst did say “AI is the future of currency exchange, making accurate predictions and saving millions.”

- RATES expertise: Machine learning integrated into blockchain systems and cryptocurrency exchanges analyzes millions of transactions daily. This process creates a database that humans would at least take hundreds of years and billions of dollars to create.

AI reduces the risk of common errors and continually detects patterns of fraud, reducing human vulnerability.

Fun Fact

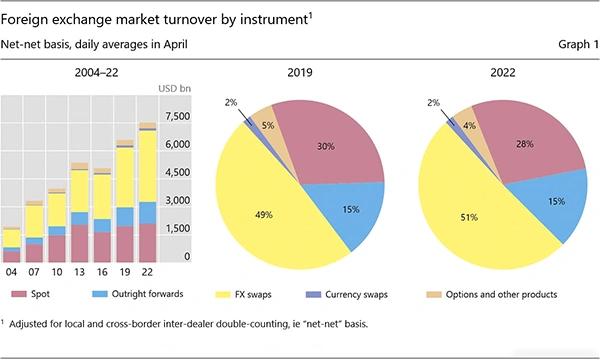

The Forex market has an average daily volume of $ 6.6 trillion per day which is equal to $250 billion per hour.

Fintech Startups

The beneficiaries of the integration of AI in finance are fintech startups, which have democratized financial services by bringing them to the screens of any digital device.

The most popular fintech services are international transactions, lending, investing, and insurance. Fintech apps tend to specialize in narrow areas of the financial industry, such as mobile payments, robo-adviser, or online lending.

- Technical side: Fintech applications use API technology to operate their interfaces, whether they are applications or websites. On the server side, data is exchanged between databases, users, and the service providers themselves to track investments, manage accounts, etc.

Users intuitively manage the processes on their device screens, seeing only the results of the AI and service provider working together.

A major objection to fintech applications is data security and customer privacy concerns. The solution is on the user side following security policies. The technology is protected by blockchain so you’ve got nothing to worry about.

For example, through smart contracts executed in real-time, give selective access to information to authorized parties, reducing the risks associated with centralized databases.

Conclusion

The world is changing rapidly, and the forex market is no exception. New technologies are already making considerable changes, while also offering opportunities that seemed like science fiction yesterday.

Where once only bankers or large financial institutions could invest, now even students can invest their money in stocks, bonds, cryptocurrencies and other assets on their mobile devices. But how prepared are you for this shift? Or, can you even handle it?

Resources like Rates don’t claim to know everything about international currency exchange, but all experts agree on one key point: Those who are first to embrace new technologies will lead the market.

Become part of the international exchange market, learn about it, study about it, and maintain discipline. You can’t just dominate the market in one day. It takes time but it is worth it. So dive deeper and take as much knowledge as you can about the international currency exchange market.